UTAC Holdings Ltd. announced that it has completed its sale to Wise Road Capital, a global private equity firm. The transaction was originally announced on January 23, 2020. In conjunction with the transaction, the Company has redeemed its $665 million 2023 bonds on August 11, 2020.

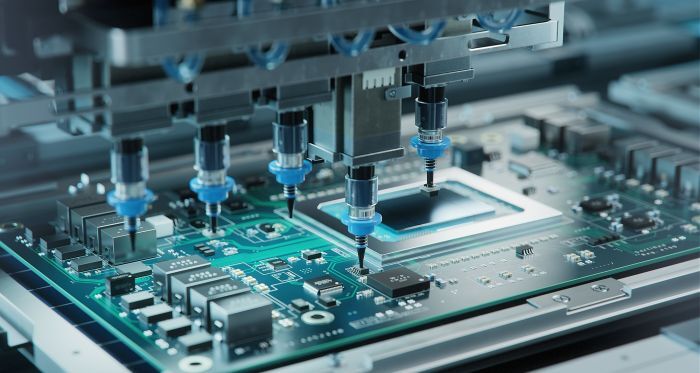

UTAC is a leading independent provider of semiconductor chip assembly and testing services, headquartered in Singapore, with production facilities in Singapore, Thailand, China, Indonesia and Malaysia.

UTAC said it will continue to be headquartered in Singapore where the company also operates two manufacturing facilities and has a significant presence. As a leading provider of assembly and test services, UTAC will continue its focus on providing its global customers with highest level of quality and support.

“We are excited to officially begin our journey with UTAC and look forward to enabling the company to accelerate its revenue growth, operational scale and product development initiatives,” said Michael Zhang, Managing Partner of Wise Road Capital.

Brighten Li, Founder of Wise Road Capital, further said, “We have a strong track record of supporting the growth and success of our portfolio companies and are excited to add UTAC to our portfolio of leading high technology and semiconductor companies”.

“We are thrilled about the next step in the journey of our company,” said Dr. John Nelson, Chief Executive Officer of UTAC. Wise Road Capital and its principals have an extensive knowledge, understanding and network within the semiconductor supply chain and will be instrumental in helping us scale our business and expand operations. In addition, as part of their investment, UTAC will significantly reduce our leverage levels, reducing our debt by approximately 40 percent and our cash interest expense by approximately 60 percent. This new capital structure enables the Company to significantly free up cash flow for investment in strategic programs and initiatives to support the successful growth of our customers.”

All Comments (0)