Industry-wide price adjustments

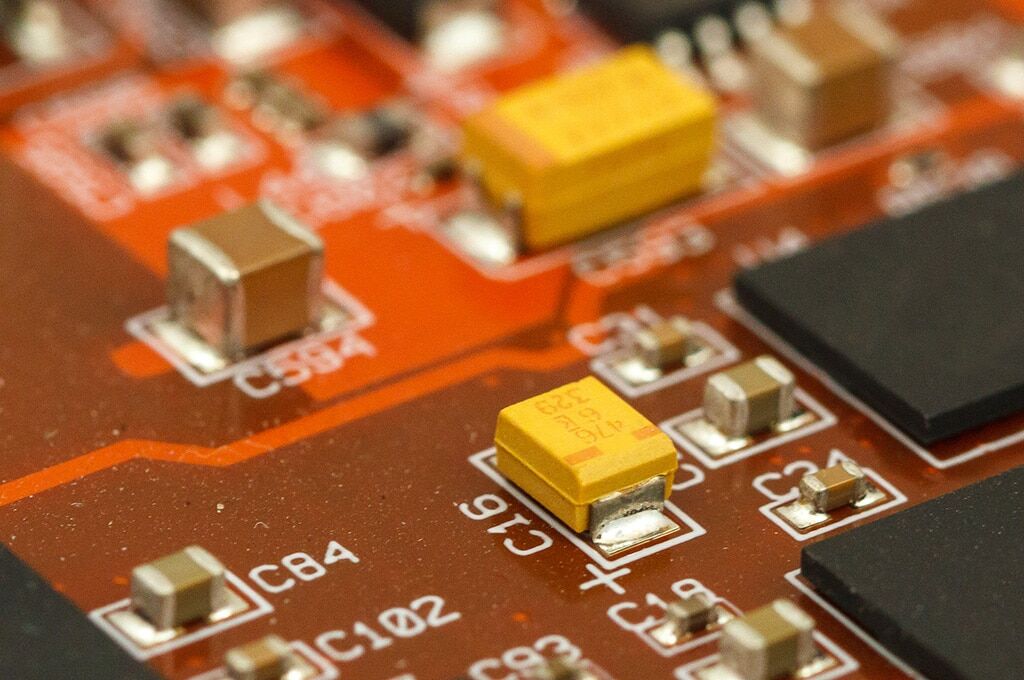

December 2, 2025 /SemiMedia/ — Panasonic has notified distributors and customers that prices for a wide range of its tantalum capacitors will increase by 15% to 30% starting February 1, 2026. Industry sources said the adjustment affects several dozen specifications, with the same rate applied to both channel partners and direct large accounts.

Distributors noted that some Panasonic models had been priced at unprofitable levels for years, and the new structure brings the portfolio closer to sustainable margins. The company last raised prices in December 2024, with higher material and manufacturing costs now prompting another round of adjustments.

The global tantalum capacitor market is highly concentrated, led by KEMET, AVX and Vishay, which together hold roughly 60% to 70% of worldwide supply. Panasonic's share is around 10%, comparable to Vishay. Analysts expect that long lead times, limited supply sources and upstream cost pressure may trigger another industry-wide price uptrend in 2026.

Market concentration and supply chain outlook

KEMET, part of Yageo Group, has already moved ahead with increases of up to 30% on its T520, T521 and T530 series effective November 1. The rises now cover both distributors and direct customers, expanding the impact across the market.

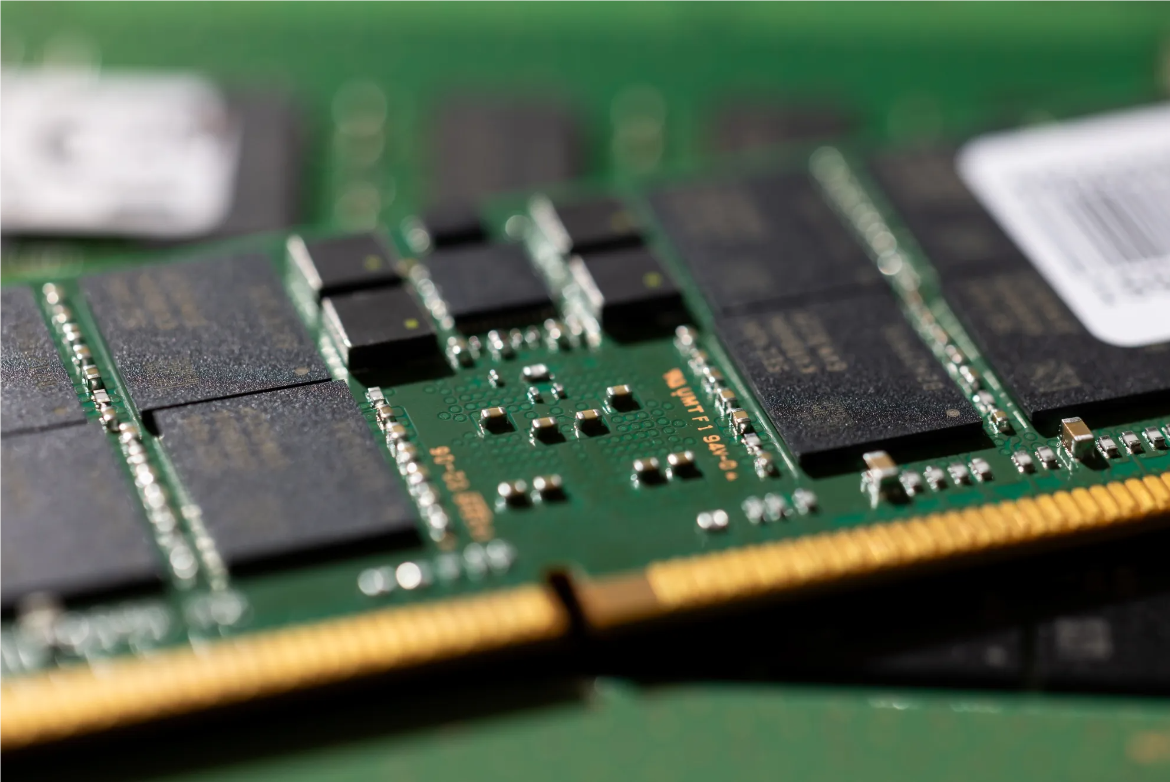

Beyond raw material inflation—particularly tantalum powder—demand from AI servers is further tightening the supply of high-end passive components. Both GB300 and ASIC-based server platforms rely heavily on tantalum capacitors, driving strong pull-in throughout the semiconductor ecosystem.

AI-driven demand reshaping component supply

Other manufacturers are also adjusting prices. Fenghua Advanced Technology recently raised prices by 5% to 30% across inductors, varistors, MLCCs and thick-film circuit products, citing sharp increases in silver, tin, copper, bismuth and cobalt prices.

With AI adoption accelerating across data centers and high-performance systems, suppliers expect sustained growth in high-end MLCCs, chip inductors, tantalum capacitors and packaging materials. The trend is also boosting demand for upstream inputs such as nickel powder, carbonyl iron, soft magnetic alloys and thermal materials, indicating a broader structural shift across the passive component supply chain.

All Comments (0)