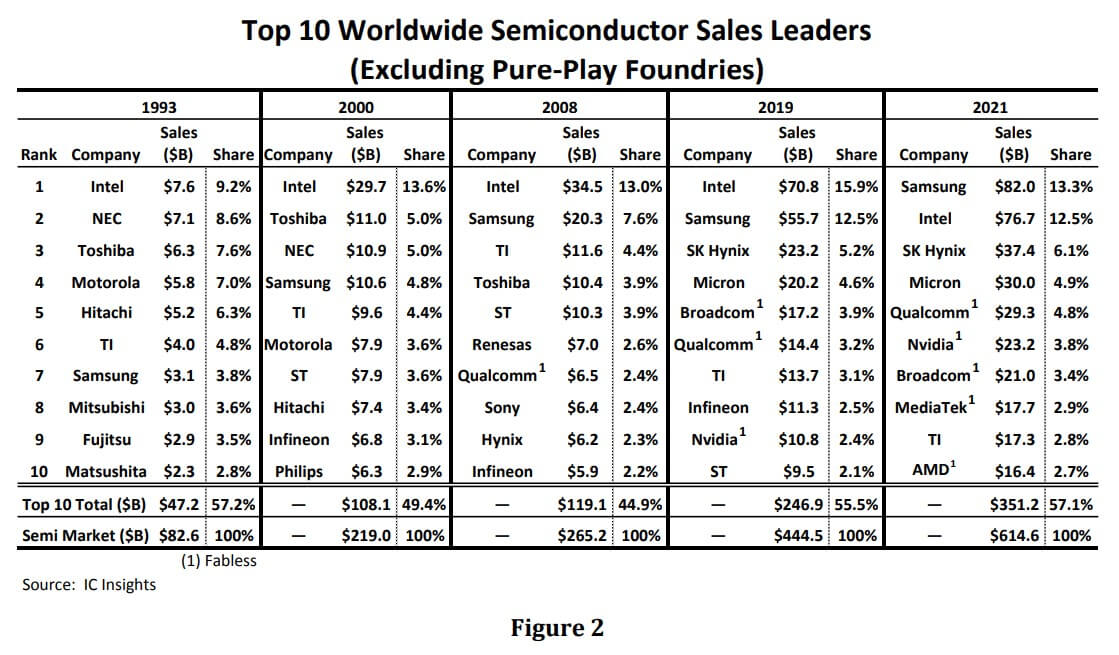

According to the latest report from IC Insights,According to the latest report from IC Insights, the top 50 semiconductor suppliers (excluding pure-play foundries) accounted for 89% of the $614.6 billion global semiconductor market in 2021, an 8% increase from the 81% share pre-2010. The top 5, top 10 and top 25 companies increased their share of the global semiconductor market in 2021 by 8, 9 and 11 percent, respectively, compared to 2010.

With more mergers and acquisitions expected in the next few years, IC Insights believes that mergers could push the top suppliers' share to even higher levels.

IC Insights noted that in 2017, for the first time since 1993, the semiconductor industry witnessed a new number one supplier. In 1993, Intel was the number one ranked supplier with a 9.2% share of the worldwide semiconductor market. In 2017, Intel's sales represented 13.9% of the total semiconductor market. In contrast, Samsung's global semiconductor marketshare was 3.8% in 1993 and 14.8% in 2017. Thus, Samsung’s accession to the number one position in the semiconductor sales ranking in 2017 had more to do with it rapidly gaining marketshare than Intel losing marketshare.

In 2019, a steep 32% drop in the memory market pulled the total semiconductor market down by 12%. Since 77% of Samsung’s semiconductor sales were memory devices that year, the memory market plunge dragged the company’s total semiconductor sales down by 29%. Although Intel’s semiconductor sales were relatively flat in 2019, the company regained its position as the number one semiconductor supplier that year (Figure 2), a position it had held from 1993 through 2016. However, Samsung regained the number one spot in the ranking in 2021 after it posted a 33% increase in sales and Intel’s sales increased an anemic 1%.

The report shows that excluding foundries, there were two new entrants into the top 10 ranking in 2021—Taiwan-based fabless supplier MediaTek and U.S.-based fabless supplier AMD. These two companies replaced Apple and Infineon in the top 10 ranking last year. MediaTek registered an amazing 61% jump in sales, which moved the company up three positions in the ranking (from 11th to 8th) while AMD posted an even larger 68% surge in sales in 2021 to go from the 14th position to the number 10 spot in the ranking.

In 2021, five of the top 10 semiconductor suppliers were fabless companies, two more than in 2019. As shown, in 2008 there was only one fabless company in the ranking (i.e., Qualcomm) and in 2000, there were none.

IC Insights pointed out that all of the top 10 companies had sales of at least $16.4 billion in 2021. As would be expected, given the possible acquisitions and mergers that could occur in the future, the top 10 semiconductor ranking is likely to undergo some significant changes over the next few years as the semiconductor industry continues along its path to maturity.

For more information and to purchase the report, please visit https://www.icinsights.com/services/mcclean-report/pricing-order-forms/

All Comments (0)