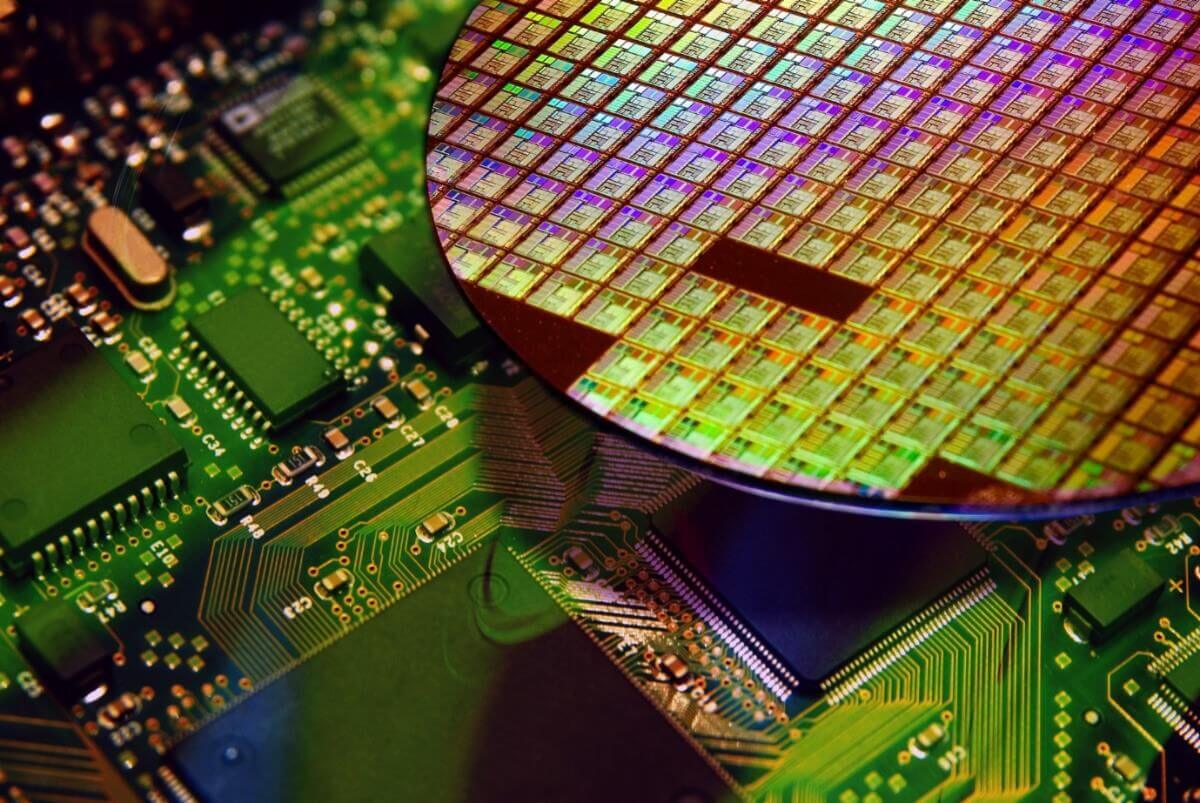

According to semiconductor supply chain sources, IDMs such as Texas Instruments, Infineon and NXP are vying for more foundry orders, while IC design companies continue to cut orders from foundries.

The source pointed out that some IC design companies have cut orders for wafer foundries or lowered their capacity forecasts. However, IDMs seem to be less affected by the market environment, emphasizing that the demand side of automobiles and industrial controls is still strong. While other IC design companies are lowering wafer prices, IDM is expanding its foundry orders to compete for more mature processes.

The source said that the material supply shortage has not been fully resolved, and the prices of some power components may rise.

IDM insiders pointed out that they are closely monitoring the overall economic situation, and based on their past experience, there is a high correlation between auto sales performance and general economic trends. The continued growth in demand for automotive electronics has prompted them to import more corresponding chip quantities.

The source also revealed that Rohm will increase product prices by about 10% from October 1, 2022, and NXP may also increase the price of automotive chips.

All Comments (0)