December 29, 2025 /SemiMedia/ — Rising memory prices are pushing up PC manufacturing costs as semiconductor suppliers shift capacity toward higher-margin products, prompting Japanese PC makers to consider price increases.

Memory cost pressure hits PC makers

Tokyo-based custom PC maker MouseComputer said it plans to raise prices from January 2026 due to surging memory costs. The company suspended online sales from Dec. 23, 2025, to Jan. 4, 2026, after receiving stronger-than-expected orders, and said pricing details are still under review.

Dynabook, a Sharp subsidiary, said DRAM price increases have exceeded what it can absorb internally and that it is examining price adjustments. MM Research Institute data show Dynabook held a 9.6% share of Japan’s PC shipments between April and September.

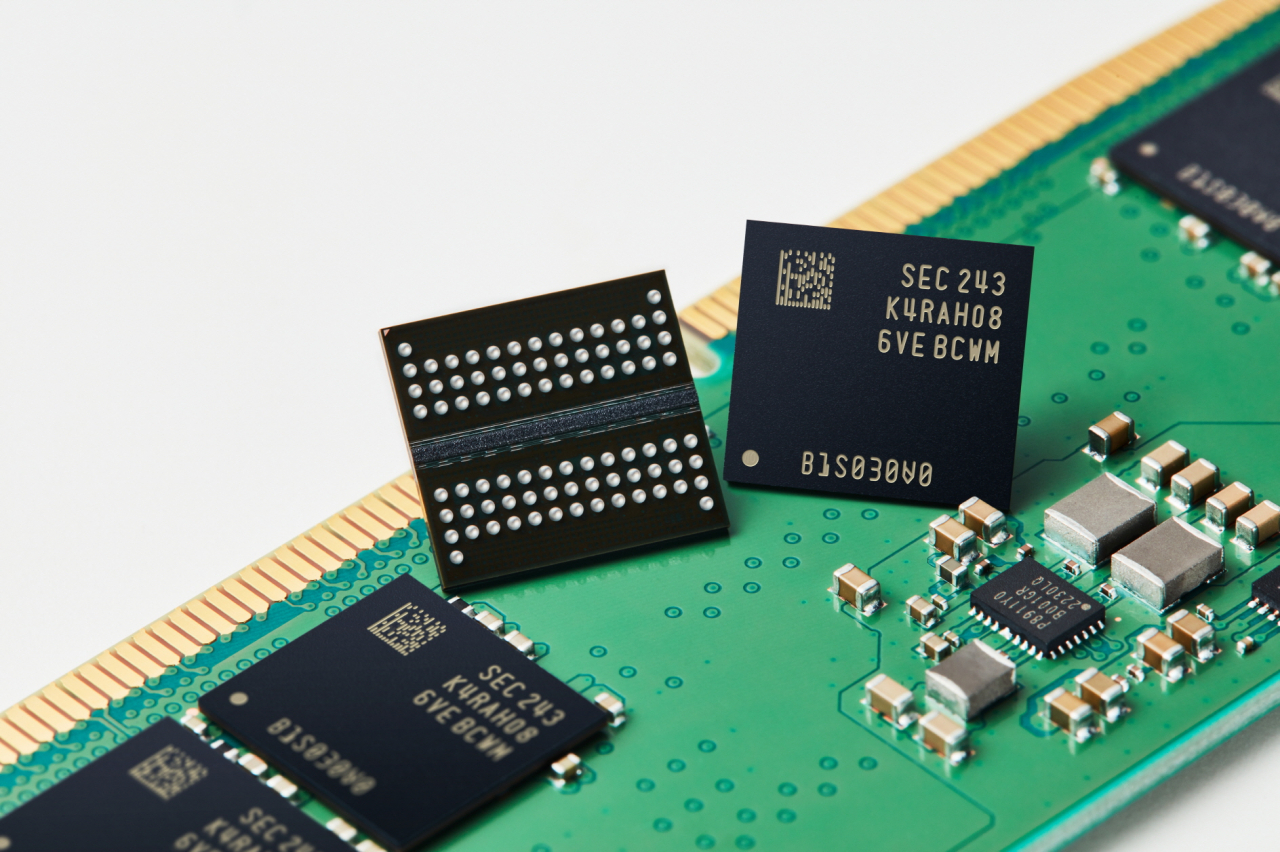

DRAM and NAND supply shifts

Unlike past cycles, the current rise in PC prices is being driven largely by higher semiconductor input costs rather than performance upgrades. DRAM- and NAND-based SSDs account for roughly 30% of a finished PC’s cost, while a weaker yen has amplified dollar-based procurement expenses.

Spot prices for benchmark DDR4 8Gb DRAM stood at around $14.10 as of Dec. 25, while contract prices for the October–December quarter rose about 80% from the previous quarter.

AI servers squeeze mainstream memory output

Samsung Electronics, SK Hynix and Micron Technology control about 90% of the global DRAM market and are increasingly allocating capacity to high-bandwidth memory for AI servers and data centers. Output of conventional DDR4 products is being reduced, tightening supply.

Industry sources said Taiwanese suppliers are attempting to raise output, but shortages persist, with major U.S. technology companies holding direct talks with memory manufacturers to secure supply.

NAND flash and SSD prices rise

Wholesale prices for TLC NAND flash climbed about 40% quarter-on-quarter in the October–December period. Japan’s Kioxia has said it will prioritize data center and enterprise markets, a move expected to further constrain PC-related supply.

IDC data show Lenovo, HP and Dell Technologies together accounted for about 60% of the global PC market in the third quarter. Lenovo said it would rely on pricing adjustments and cost controls to protect margins. Omdia estimates PC makers may need to raise prices by 10% to 20% to remain profitable.

TrendForce said rising memory costs are also beginning to affect smartphones, potentially influencing pricing decisions for future models.

All Comments (0)