December 29, 2025 /SemiMedia/ — A wave of price increases across foundry and memory markets is signalling a new phase of adjustment in the semiconductor industry, as tight supply and rising costs ripple through the value chain.

Foundry price increases signal structural shift

In December, China’s Semiconductor Manufacturing International Corp raised prices for its 8-inch BCD process by about 10%, with Taiwan-based Vanguard International Semiconductor following suit. Earlier this year, Hua Hong Semiconductor lifted prices for mature nodes, while TSMC has said it plans to raise prices for sub-5nm processes from January 2026, with annual increases of around 3% to 5%.

The latest adjustments span both mature and advanced nodes and involve major foundries on both sides of the Taiwan Strait, pointing to a broader structural repricing rather than isolated corrections.

AI-driven demand tightens mature-node capacity

On the demand side, sustained growth in AI-related applications has pushed up demand for power management and control chips, tightening capacity for specialty processes such as BCD. Seasonal smartphone demand and rising automotive semiconductor content have further increased pressure on 28nm and above nodes, while low global IC inventories have prompted customers to place orders earlier to secure capacity.

Limited supply and rising costs reinforce pricing power

Supply-side flexibility remains limited. TSMC continues to scale back 8-inch capacity in favour of advanced nodes, while utilisation rates at SMIC and Hua Hong remain high, leaving little room for rapid output expansion in the near term.

Cost pressures are also feeding into higher prices. Elevated prices for key raw materials such as gold and copper, recent price hikes by leading silicon wafer suppliers, and rising energy and labour costs have squeezed foundry margins, reinforcing the push to pass costs downstream.

Pricing pressure spreads across the semiconductor value chain

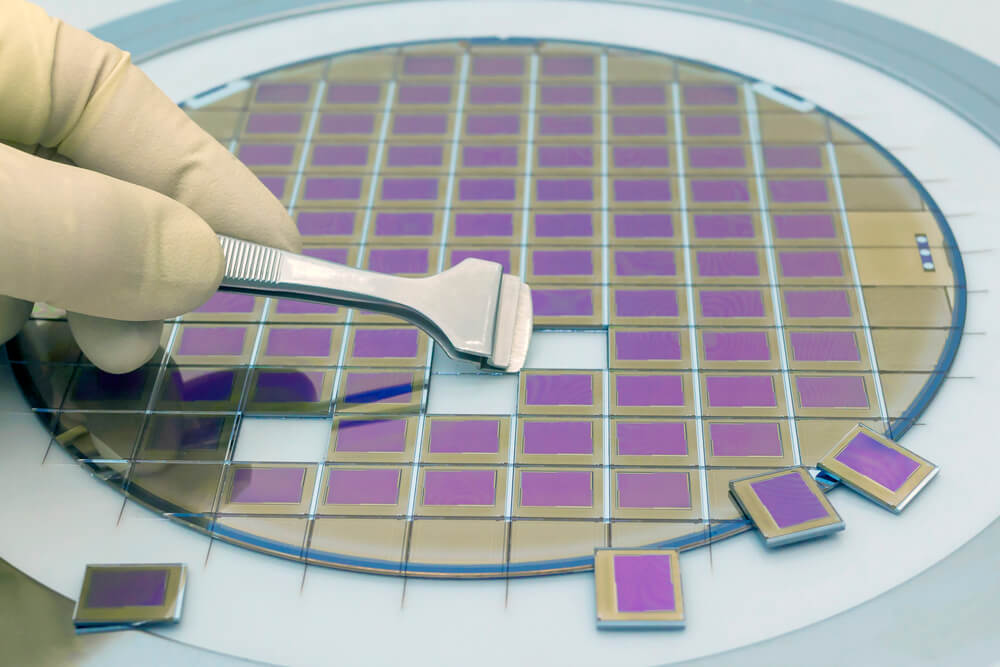

The impact is spreading along the supply chain. Equipment and materials suppliers are benefiting from fab expansion and localisation efforts, while foundries are using price increases and capacity reallocation to improve profitability. Smaller foundries have also begun raising 200mm wafer prices and shifting resources toward higher-margin processes.

Downstream, chip designers and end-market players face mounting pressure. Companies in consumer electronics, automotive and memory-related segments are seeing costs rise sharply, with weaker players facing margin erosion or market exit. Some low- to mid-end products are likely to see price increases, while larger customers rely on long-term agreements to manage volatility.

In the short term, strong AI-related demand and long construction cycles suggest pricing pressure could extend to more segments. Over the medium term, new domestic capacity may ease tightness at mature nodes, while advanced process supply is expected to remain constrained, reinforcing pricing power for leading manufacturers.

All Comments (0)