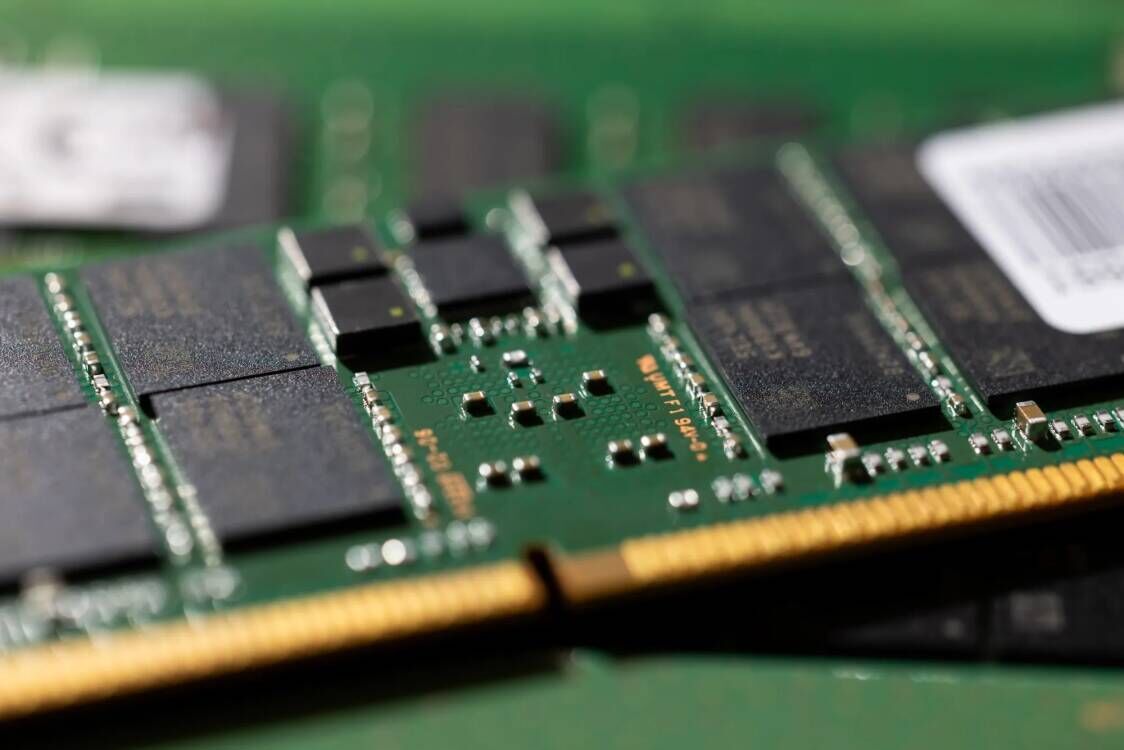

December 18, 2025 /SemiMedia/ — Tightening supply conditions in the storage market are adding upward pressure to NAND flash and solid-state drive (SSD) prices, with shortages expected to intensify in the near term, industry sources said.

Kingston’s data center SSD business manager Cameron Crandall warned that NAND flash availability could worsen within the next 30 days, driving further price increases for SSDs. He also expects memory and SSD pricing to remain on an upward trajectory throughout 2026.

NAND flash supply constraints drive SSD pricing

NAND flash, which typically accounts for around 90% of a conventional SSD’s material cost, remains the primary driver of pricing dynamics. A sharp rise in NAND prices this year has significantly lifted production costs, with the impact now feeding through to end-market pricing. Enterprise SSDs have been the first segment to see both volumes and prices rise simultaneously.

According to research firm TrendForce, market sentiment in the global storage sector shifted from recovery to active inventory competition in the fourth quarter of 2024. After several volatile cycles, NAND suppliers have adopted a more cautious approach to capacity expansion, resulting in supply growth lagging behind demand.

AI-driven demand reshapes the global storage market

The rapid expansion of artificial intelligence applications has emerged as a key catalyst behind the imbalance. Cloud service providers and other major buyers have accelerated enterprise SSD stockpiling to avoid delays in costly AI server deployments, further tightening supply.

TrendForce forecasts that average contract prices for enterprise SSDs will rise by more than 25% quarter-on-quarter in the fourth quarter, potentially lifting overall industry revenue to near record levels.

The price uptrend is not limited to SSDs. Media reports indicate that traditional hard disk drive (HDD) prices have also increased, indirectly supported by AI-related demand. Industry sources said the current shortage has evolved beyond individual NAND components, affecting a broad range of storage products and underscoring a global supply-demand imbalance across the storage sector.

All Comments (0)