TE Connectivity announces broad connector price increase from 2026

December 15, 2025 /SemiMedia/ — TE Connectivity is set to implement a broad-based price increase across its global connector portfolio from early 2026, a move expected to add cost pressure across the semiconductor, automotive and data center supply chain, according to industry sources and channel communications.

In a notice sent to authorised distributors, the company said the price adjustment will take effect on January 5, 2026, citing persistent inflationary conditions and rising input costs, including higher metal prices. The increase will apply across all regions and authorised distribution channels, the notice showed.

Connector price hikes add pressure to semiconductor supply chains

Distributors said the adjustment covers nearly all major TE product categories, ranging from automotive-grade connectors and high-speed backplane connectors to spring terminals and industrial interconnect products. Price increases for some product lines are expected to fall in the 5% to 12% range, representing a moderate but wide-reaching structural increase.

TE Connectivity has been a dominant force in the global connector market for decades, supplying critical interconnect solutions to automotive, communications, industrial and aerospace sectors. Data from Bishop & Associates show TE has maintained the largest global market share in connectors for more than 20 years, giving it significant pricing power in high-reliability and high-speed applications.

Industry participants said the impact of the price increase will extend beyond the connector market itself. Higher interconnect costs are likely to be passed along the value chain, affecting system makers involved in vehicle electronics, industrial automation and AI-driven data center infrastructure.

The pricing move comes amid solid financial performance at TE. The company reported third-quarter net sales of $4.5 billion, up 14% year on year, supported by roughly 30% growth in its industrial segment, driven by strong demand for AI-related high-speed connectivity and energy applications. Its transportation segment also posted growth, supported by electrification and vehicle data connectivity, particularly in Asian markets.

Price increases reflect wider cost inflation across the chip industry

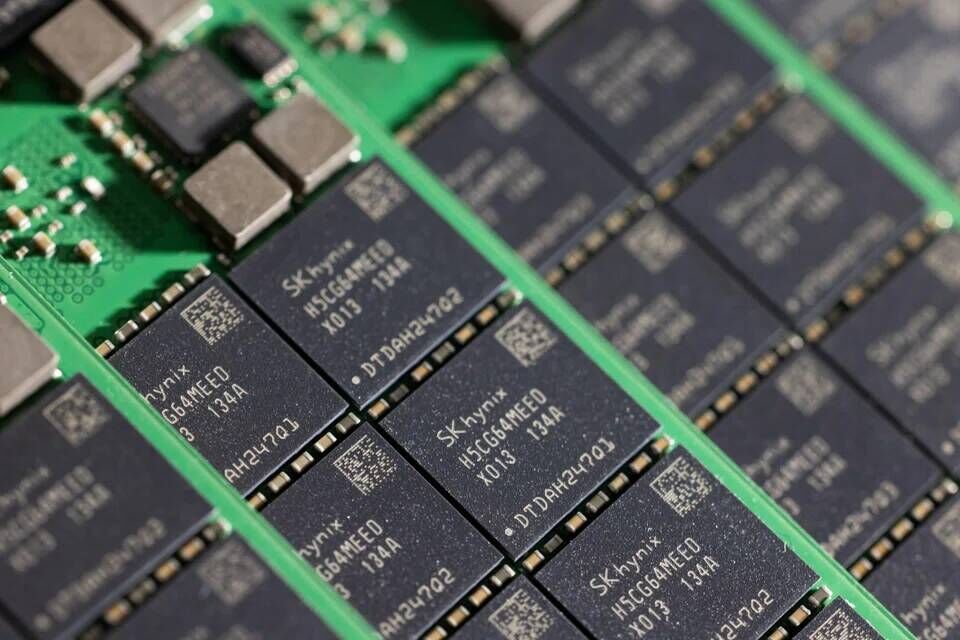

TE’s action reflects a broader pricing trend across the electronics and semiconductor supply chain. Memory chipmakers have raised prices amid AI demand and HBM capacity constraints, while passive component suppliers have followed rising precious metal costs. Foundries have also continued to adjust pricing for advanced process nodes, pushing system-level costs higher.

All Comments (0)