Major Japanese lenders back Rapidus 2nm semiconductor financing

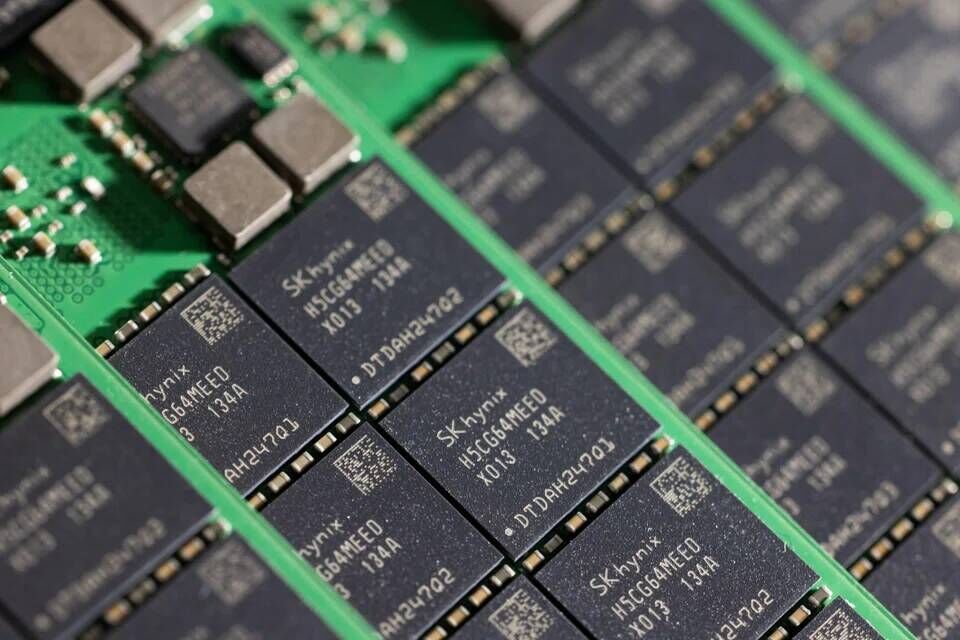

December 15, 2025 /SemiMedia/ — Japan’s three largest banking groups have signaled their willingness to provide substantial financing to Rapidus, as the country-backed chipmaker moves toward mass production of advanced logic semiconductors.

Mitsubishi UFJ Financial Group, Sumitomo Mitsui Banking Corp and Mizuho Bank have submitted a joint document indicating plans to extend loans to Rapidus in stages from fiscal 2027, according to people familiar with the matter. The total loan package could reach as much as ¥2 trillion (about $13 billion), aligning with the company’s planned ramp-up of 2nm manufacturing.

Rapidus positioned at center of Japan’s advanced chip strategy

Beyond debt financing, Japan’s banking sector is also considering a deeper equity commitment to the project. The three megabanks, together with the Development Bank of Japan, are discussing additional investments of up to ¥25 billion (about $160 million). MUFG previously invested ¥300 million (around $1.9 million) in Rapidus in 2022, underscoring growing financial-sector involvement in what is Japan’s most ambitious semiconductor manufacturing initiative in decades.

Founded in August 2022, Rapidus is building a wafer fabrication plant in Hokkaido, Japan’s northernmost main island. The company aims to begin mass production of 2nm chips in fiscal 2027 and targets profitability around fiscal 2030.

Looking further ahead, Rapidus is also preparing for next-generation 1.4nm technology. Its shareholder base includes Toyota Motor, SoftBank Group, NTT Group and Sony Group, positioning the company as a central pillar in Japan’s strategy to rebuild domestic advanced semiconductor manufacturing capacity.

All Comments (0)