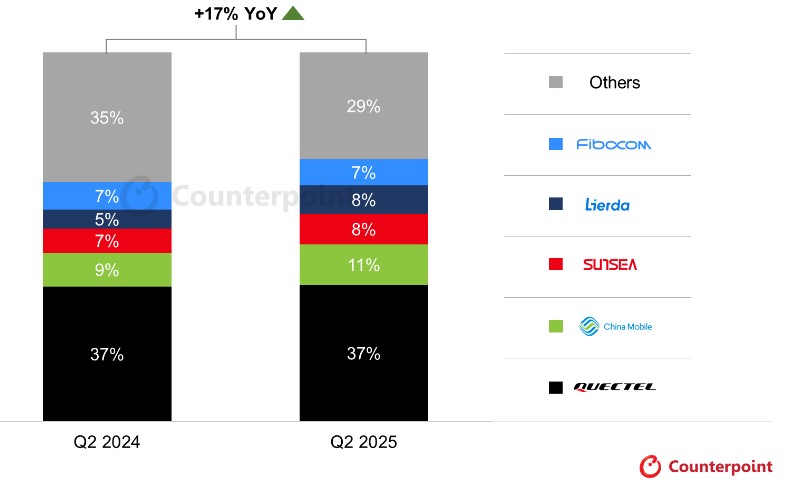

September 18, 2025 /SemiMedia/ — Global shipments of cellular IoT modules rose 17% year-on-year in the second quarter of 2025, marking six straight quarters of growth, according to Counterpoint Research. The rebound highlights robust demand across utilities, automotive deployments and the early adoption of 5G RedCap, with momentum expected to continue through the second half of the year.

India and China were the only markets to sustain growth for six consecutive quarters. India’s expansion was driven by smart meters and POS terminals, while asset tracking and surveillance cameras boosted China’s market. Latin America delivered the strongest regional performance, surging 32% on the back of smart meter rollouts, router and CPE adoption, and tracking solutions.

On the vendor side, Quectel remained the global leader, followed by China Mobile. Fibocom’s unit SimCom and LongSung posted nearly 50% growth, moving the company into third place ahead of Fibocom. Lierda climbed to fourth with strong Cat 1 bis momentum, supported by Chinese demand for IP cameras and expanding into Korea, where Cat 1 bis is beginning to replace LTE-M in telematics and asset tracking.

In the chipset segment, Qualcomm retained its lead in automotive, PC and router applications, particularly in 5G and high-end 4G categories such as Cat 4 and Cat 6. ASR and Eigencomm focused on cost-sensitive markets, supplying 4G Cat 1 bis solutions for metering, asset tracking, industrial cameras and smart speakers.

All Comments (0)