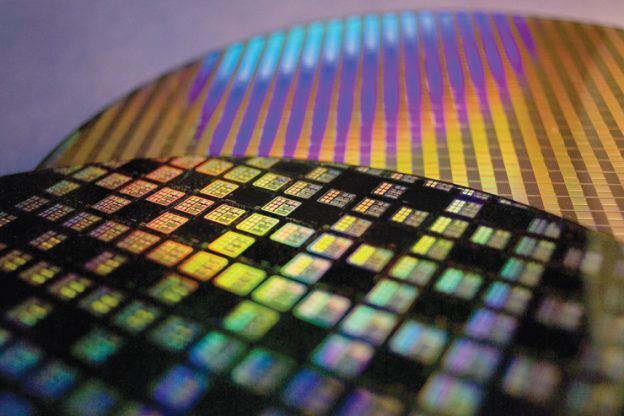

September 17, 2025 /SemiMedia/ — Global semiconductor Foundry 2.0 revenue grew 19% year-on-year in the second quarter of 2025, driven by surging demand for advanced nodes and packaging fueled by artificial intelligence. TSMC’s market share rose from 31% a year earlier to 38%, setting a new record, supported by ramping 3nm production and CoWoS capacity expansion.

Counterpoint Research said the growth momentum is expected to continue into the third quarter, with revenue projected to rise by a mid-single-digit percentage.

The OSAT sector also recorded notable gains, with industry revenue growth accelerating from 5% to 11%. ASE delivered the largest contribution, while King Yuan Electronics benefited from strong AI GPU demand, posting growth of more than 30%.

Advanced packaging is seen as the key growth driver for OSAT players, particularly with AI GPUs and AI ASICs expected to play a central role through 2025 and 2026. Non-memory IDMs have returned to positive growth, although automotive demand remained weak in the first half and is likely to recover in the second half.

“Advanced packaging has become increasingly critical for chip performance, and TSMC will remain at the forefront not only in advanced nodes but also in packaging technologies,” said William Li, senior analyst at Counterpoint Research.

Counterpoint Research also emphasized that Foundry 2.0 extends beyond traditional wafer manufacturing (Foundry 1.0). It includes pure-play foundries, non-memory IDMs, OSATs and photomask suppliers, reflecting the industry’s shift toward integrated technology platforms to meet AI-driven system optimization needs.

All Comments (0)