July 28, 2025 /SemiMedia/ — Samsung Electronics said on Sunday it has signed a 22.8 trillion won ($16.5 billion) foundry agreement with U.S. electric vehicle maker Tesla, marking a major step to revive its loss-making chip contract manufacturing business.

The deal, finalized on July 26, runs from July 24, 2025 to December 31, 2033, and represents 7.6% of Samsung’s projected 2024 revenue. Samsung said contract terms will remain confidential until expiration.

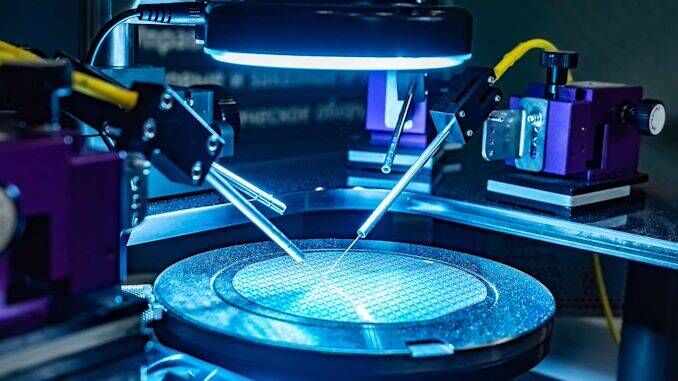

Tesla CEO Elon Musk confirmed that Samsung will manufacture its next-generation AI6 chips at the company’s new wafer fab in Taylor, Texas. Samsung is already producing Tesla’s current AI4 chips, while AI5 chips will be made by TSMC in Taiwan and later in Arizona.

Analysts believe the Tesla deal will rely on mature process nodes, rather than Samsung’s advanced 2nm technology, which is still struggling with yield issues. BNK Investment & Securities analyst Lee Min-hee said the deal is unlikely to involve leading-edge nodes.

Samsung, the world’s largest memory chip maker, is also working to expand its foundry business, which manufactures custom-designed logic chips for clients including Tesla and Qualcomm. However, the Korean tech giant continues to lose ground to foundry leader TSMC, which counts Apple and Nvidia as key customers.

Kiwoom Securities analyst Pak Yuak estimates that Samsung’s foundry division lost more than 5 trillion won ($3.63 billion) in the first half of 2025. He said the Tesla contract could significantly reduce losses over the coming years.

The agreement comes amid broader efforts by South Korea and the United States to deepen cooperation in semiconductors and other strategic sectors. Seoul is seeking to secure favorable trade terms and avert a proposed 25% tariff currently under discussion in Washington.

All Comments (0)