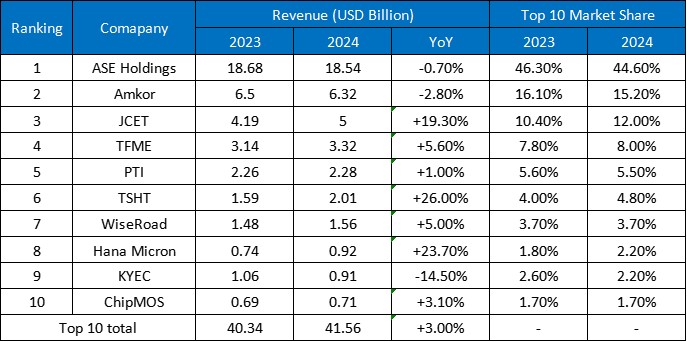

May 14, 2025 /SemiMedia/ — The world’s top 10 outsourced semiconductor assembly and test (OSAT) providers generated $41.56 billion in revenue in 2024, up 3% from the previous year, according to a report by research firm TrendForce.

Despite the modest growth, the OSAT sector is undergoing a shift driven by advanced packaging needs and regional momentum. ASE Group maintained the top position with revenue of $18.54 billion, accounting for nearly 45% of the top 10 total. Amkor Technology followed with $6.32 billion, down 2.8% due to weak recovery in automotive electronics caused by slow car sales and inventory adjustments.

China-based JCET ranked third, posting a 19.3% increase to $5 billion in revenue. The company benefited from improving consumer electronics demand and platform upgrades in AI PCs and mid-range smartphones, which helped fill its standard packaging capacity. Tongfu Microelectronics secured the fourth spot with $3.32 billion, up 5.6%, supported by a rebound in communications and consumer markets, as well as strong business from AMD.

TrendForce noted that the 2024 OSAT market reflected broader transformation trends across the semiconductor supply chain. Increasing requirements for high-density, high-frequency packaging—driven by AI and edge computing—are accelerating the adoption of wafer-level packaging, heterogeneous integration, stacked dies, and advanced testing.

This shift is repositioning OSAT companies from traditional contract manufacturers to innovation-led technology enablers, turning the packaging sector into a strategic core of the semiconductor ecosystem.

TrendForce concluded that the market is evolving with stable leaders and emerging regional players reshaping competition, setting the stage for the next wave of advancement in heterogeneous and high-end packaging technologies.

All Comments (0)