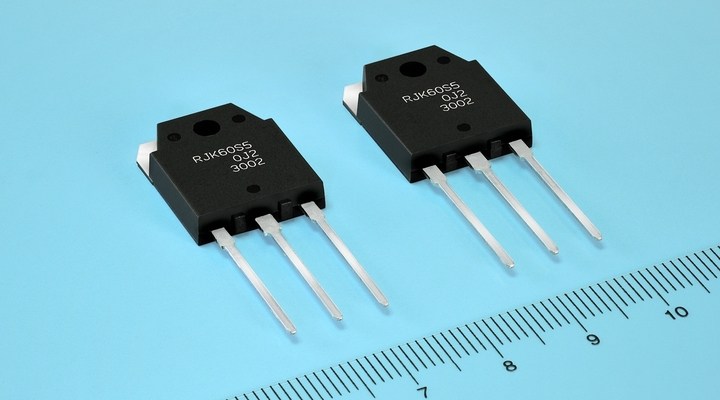

According to reports, the global MOSFET supply is tightening. Currently, Infineon, STMicroelectronics and other international IDM's MOSFET production capacity in the second half of the year have all been reserved, ODM/OEM factories are switching orders to Taiwan MOSFET manufacturers at the moment. As of this month, orders for third-quarter MOSFET manufacturers in Taiwan including Advanced Power Electronics Corp. (APEC), Sinopower Semiconductor, Niko Semiconductor Co., Ltd (Niko-Sem) and Excelliance MOS Co., Ltd. (EMC) are full, even the production capacity which has higher price (5-10% increased) is also been reserved, now they are begin to accepting October orders.

According to industry experts, the MOSFET orders in the fourth quarter of Taiwan are in an outburst state, the production capacity should be ordered before the end of July, and prices may increase by another 5 to 10%.

Before the end of June, International IDM companies has confirmed the volume and price of MOSFETs order in the second half of the year with major customers. According to distribution practitioners, IDM companies including Infineon, STMicroelectronics, ON Semi, and Vishay have extended their MOSFET lead time again, in which the delivery of low-voltage and high-voltage MOSFETs has generally extended to 30 ~ 40 weeks, the IGBT lead time is about 30 weeks.

Since only 27 weeks are left in the second half of this year. The IDM companies which has lead time more than 30 weeks means that its production capacity in the second half of the year has been fully booked. According to industry analysts, the global IDM manufacturers has shifted MOSFET production capacity to high-margin automotive and industrial applications while increasing IGBT and integrated power module (IPM) production capacity, leading to MOSFET shortage. In addition, while the international IDM companies are shifting its production capacity to a high-margin automotive or industrial application product line, the price of MOSFETs for general consumer and communications applications has continued to increase, and EOL notifications has been issued for some low-margin products which is for traditional applications use. In this case, the Taiwan MOSFET factories can be said to benefit directly.

All Comments (0)