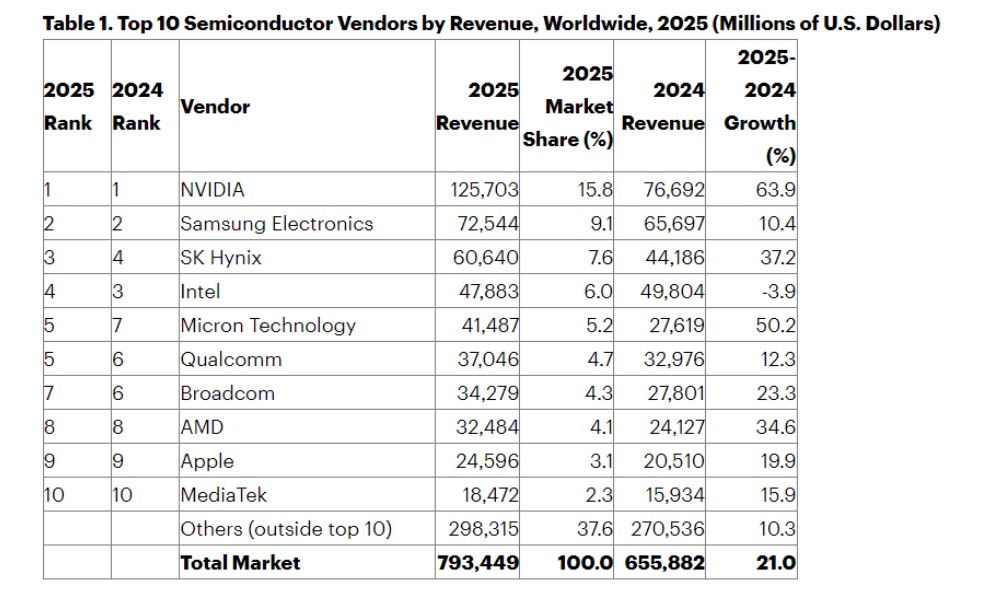

January 16, 2026 /SemiMedia/ — Global semiconductor revenue reached $793 billion in 2025, rising 21% from a year earlier, as demand for artificial intelligence chips reshaped the industry and lifted overall market growth, according to preliminary data from Gartner.

AI-related products, including processors, high-bandwidth memory and networking chips, accounted for nearly one-third of total semiconductor sales, Gartner said. Spending on AI infrastructure is expected to continue climbing and could exceed $1.3 trillion in 2026.

Nvidia emerged as the world’s largest semiconductor supplier in 2025, posting revenue of $125.7 billion, up 63.9% from 2024. Its market share reached 15.8%, and the company contributed more than a third of the industry’s total revenue growth, Gartner estimated.

Samsung Electronics ranked second with $72.5 billion in semiconductor revenue, supported by improving demand for memory used in AI servers, though sales in its non-memory businesses declined. SK hynix climbed to third place as shipments of high-bandwidth memory surged alongside AI server deployments.

In contrast, companies more exposed to traditional PC and general-purpose processor markets faced a tougher year. Intel’s revenue slipped 3.9% to $47.9 billion, with its market share narrowing to around 6%, reflecting the shift toward AI accelerators and specialized memory.

Gartner said high-bandwidth memory accounted for about 23% of the DRAM market in 2025, generating more than $30 billion in sales, while AI processors exceeded $200 billion. The firm expects AI-related chips to represent more than half of global semiconductor revenue by 2029.

All Comments (0)