January 13, 2026 /SemiMedia/ — The global memory market has entered a “supercycle,” with pricing momentum surpassing the peak seen in 2018, as surging demand from artificial intelligence and server infrastructure strains supply, according to Counterpoint Research.

The research firm said suppliers now hold record pricing power, driven by strong uptake of high-capacity memory in data centers. Memory prices are forecast to rise by 40%–50% in the fourth quarter of 2025, followed by another 40%–50% increase in the first quarter of 2026, with gains of around 20% expected in the second quarter.

Server-class products are seeing the sharpest increases. Prices for 64GB RDIMM modules have climbed from about $255 in the third quarter of 2025 to roughly $450 in the fourth quarter, and are projected to reach around $700 by March 2026. Counterpoint said prices approaching $1,000 for certain products cannot be ruled out if supply constraints persist.

Rising memory costs are reshaping bill-of-materials structures across hardware segments. In smartphones, memory now accounts for a growing share of flagship device costs. High-end models equipped with 16GB–24GB of LPDDR5X and 512GB–1TB of UFS 4.0 storage could see memory-related components represent 20% or more of total BoM under current pricing conditions.

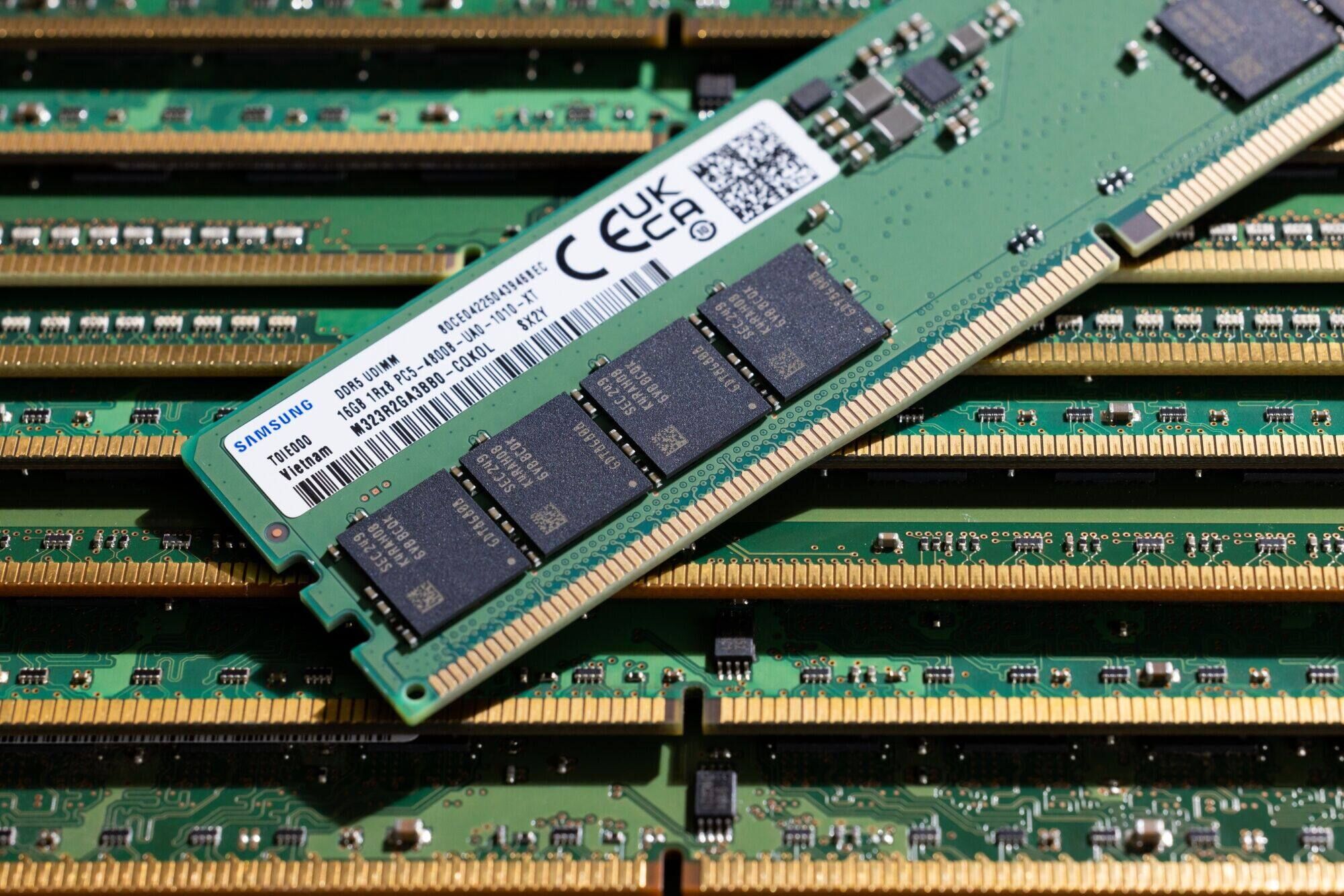

On the supply side, major manufacturers including Samsung Electronics and SK Hynix, along with China-based CXMT, are increasingly allocating capacity to higher-margin server DDR5 products. This shift has led to a rapid contraction in the supply of older-generation technologies such as LPDDR4 and eMMC.

Counterpoint said the imbalance between supply and demand remains structural. While global DRAM output is expected to grow by about 24% in 2026 and leading vendors continue to expand capital spending, capacity additions are unlikely to keep pace with accelerating AI and data center demand. Samsung has previously warned that tight memory supply could push up costs across the broader electronics industry.

All Comments (0)