January 8, 2026 /SemiMedia/ — Samsung Electronics and SK Hynix are insisting on quarterly DRAM supply contracts with customers, stepping back from long-term supply agreements as expectations of sustained price increases continue to build, industry sources said.

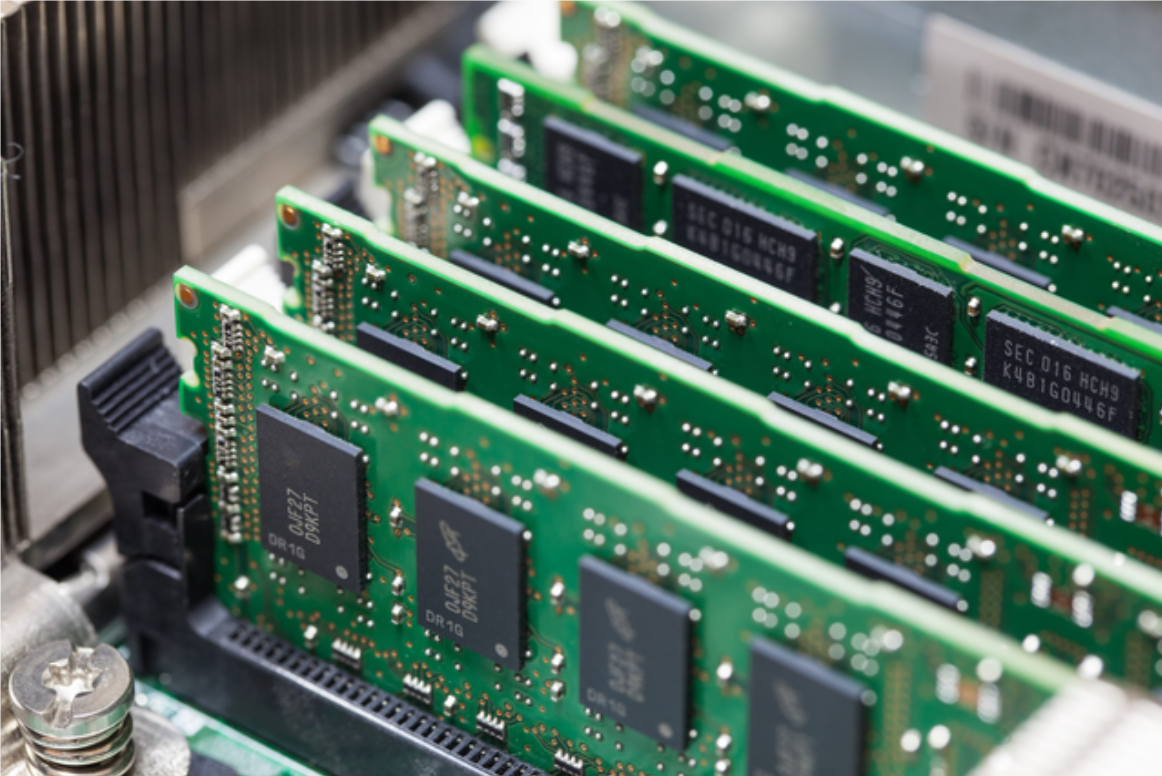

Memory suppliers tighten contract terms amid rising DRAM prices

The shift reflects a broader change in the memory market, where suppliers are increasingly reluctant to lock in prices amid strong demand from AI servers and a tightening supply outlook. Market participants widely expect DRAM prices to rise on a step-by-step basis through 2027.

AI server demand reshapes DRAM pricing negotiations

In recent negotiations, the two South Korean memory makers quoted first-quarter DRAM prices to key server customers that were around 60% to 70% higher than fourth-quarter levels, according to people familiar with the discussions. The offers were largely focused on server-grade DRAM products used in large-scale data centres.

Customers receiving the quotes include major cloud service providers such as Microsoft, Amazon and Google, which are racing to expand AI server capacity and secure sufficient memory supply. Some procurement teams have recently travelled to South Korea to negotiate volumes directly with the suppliers, the sources said.

Industry officials noted that large cloud companies are currently prioritising supply security over short-term pricing. With AI infrastructure spending continuing to rise, quarterly contracts are increasingly viewed as an acceptable trade-off to ensure access to critical DRAM capacity.

All Comments (0)