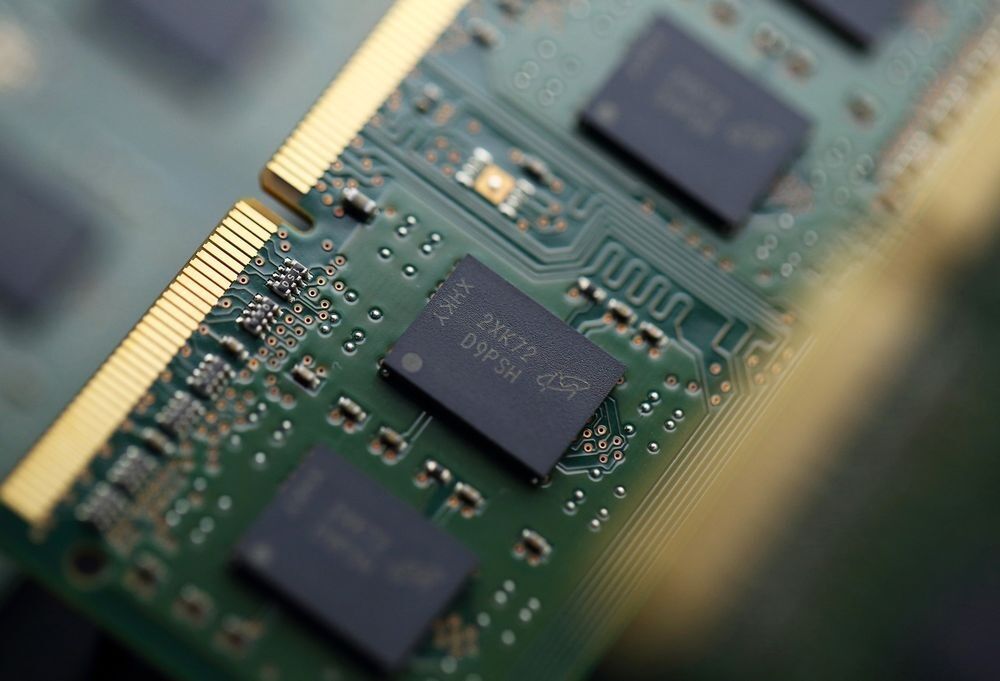

November 06, 2025 /SemiMedia/ — Winbond Electronics expects structural shortages in DDR4 to persist as major DRAM suppliers shift advanced process nodes toward DDR5 and HBM products.

Winbond president Pei-Ming Chen said global Tier-1 DRAM makers pushing below 14nm are unable to run DDR3/DDR4 profitably because those legacy standards were not designed with built-in ECC. JEDEC standards also do not allow DDR3/DDR4 to adopt ECC under those nodes, forcing new fabs to prioritize DDR5. That is creating an unavoidable supply gap in DDR4, which Winbond believes may last until 2027.

Winbond reported its DRAM (CMS) business achieved a three-year high in the third quarter, supported by demand recovery and the ramp of 20nm production. DDR4 output on 20nm doubled quarter-on-quarter and will rise again in the current quarter.

Chen added that installed servers, PCs and many fixed SoC platforms still need DDR4. Customers are actively negotiating multi-year contracts with suppliers that can commit to DDR4 continuity. Winbond remains optimistic on the fourth quarter and expects revenue, shipments and ASP to progressively normalize.

All Comments (0)