October 27, 2025 /SemiMedia/ — According to several industry sources, some major memory manufacturers have suspended price quotations for DRAM and Flash products, while others are offering prices with only brief validity due to rapid market fluctuations.

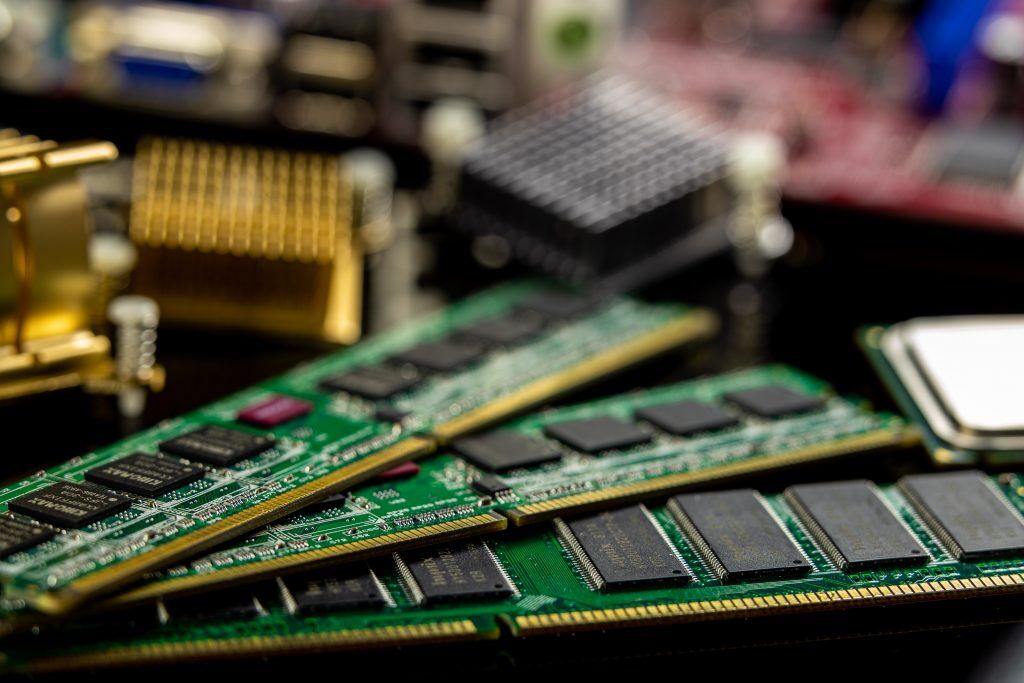

A memory module maker said the company still holds some inventory, so recent price hikes have temporarily lifted its gross margins. Another module supplier reported tighter supply since the fourth quarter and is negotiating price adjustments with downstream clients. Distributors, meanwhile, noted limited impact on margins but increased volatility in order volumes.

The memory market has entered a rare and prolonged upcycle this year. Prices have been rising since the first half of 2025 and show no sign of easing in the fourth quarter. “In all my years in the industry, I’ve never seen a price rally last this long,” one veteran industry participant remarked.

Market data show that some DRAM and Flash makers have halted regular quotations, with prices changing almost daily. This week, the spot price for 16Gb DDR4 3200 surged to $13 — up about 30% from last week — while 512Gb Flash wafer prices have risen more than 20% since early October.

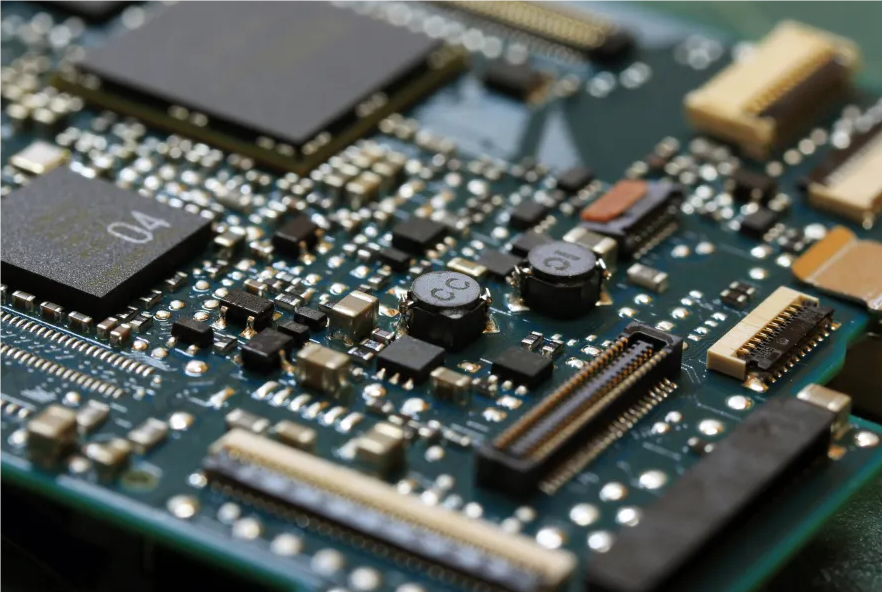

Analysts attribute the surge to a structural shift in supply and demand driven by the rapid adoption of AI technologies. As large language model applications expand, global cloud service providers are securing capacity and building inventory early. Each AI server requires five to twenty times more memory than a traditional server and relies heavily on high-bandwidth memory (HBM), pushing both prices and volumes higher.

To capture higher margins, major global memory manufacturers are reallocating capacity to advanced products such as HBM and DDR5, reducing production of legacy types like DDR4 and LPDDR4X. This has tightened supply for consumer electronics and led to structural shortages in certain segments.

Chinese memory companies are adjusting their strategies in response. Module makers are increasing inventory and moderately raising prices, while design and distribution firms are moving toward higher-value segments. At the same time, domestic manufacturers are accelerating investment in HBM, advanced packaging, and DDR5 for servers, aiming to strengthen China’s position in the high-end memory market.

Analysts expect that as new HBM capacity comes online, HBM3e could face temporary oversupply in 2026. However, HBM4 — which requires more advanced manufacturing — is still projected to remain in short supply over the long term.

All Comments (0)