October 10, 2025 /SemiMedia/ — Industry sources say China’s rapid rise in silicon wafer production and aggressive price cuts have taken the global semiconductor market by surprise. Over the past two years, local wafer makers have sharply reduced prices, with some 12-inch wafers selling for less than half the price of Japanese rivals.

In global markets, 12-inch wafers typically sell for around $60 to $80 each, while some Chinese suppliers are offering them for roughly $40 or less — below the estimated production cost of most international manufacturers. This trend underscores China’s growing efficiency in scaling production and reducing costs.

At the same time, several Chinese electronics manufacturers are encouraging chip suppliers to adopt domestically produced wafers. According to industry insiders, major display panel makers have begun requiring their driver IC suppliers to prioritize local silicon materials to enhance supply stability and cost competitiveness.

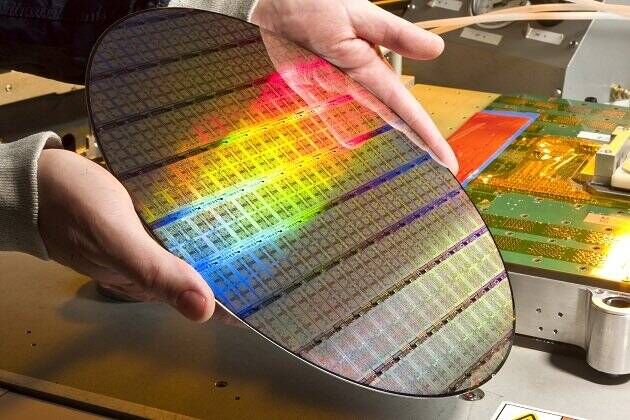

Silicon wafers form the foundation of semiconductor production and have long been dominated by global suppliers such as Shin-Etsu Chemical, Sumco, GlobalWafers, Siltronic, and SK Siltron. But China’s drive to localize its semiconductor supply chain has made wafer manufacturing a key strategic focus.

Goldman Sachs projects that by 2025, domestic suppliers could meet around 45% of China’s 12-inch wafer demand, exceeding 50% by 2027. According to Bernstein Research analyst David Dai, China’s progress in wafer self-sufficiency is faster than many anticipated, particularly in mature-node processes.

“Excluding foreign fabs such as Samsung, TSMC, and SK Hynix, over half of the 12-inch wafers used by Chinese chipmakers are already sourced domestically,” Dai noted. “For 8-inch wafers, the self-sufficiency rate is about 80%, and even higher in memory manufacturing.”

Analysts say larger wafers represent more advanced and efficient chip production. With China’s manufacturers continuing to expand capacity and refine their technology, the global wafer market is entering a new phase of competition that could reshape established supply relationships.

All Comments (0)