July 22, 2025 /SemiMedia/ — NXP Semiconductors reported a 6.4% year-over-year decline in second-quarter revenue to $2.93 billion, slightly beating analysts’ estimates of $2.9 billion. Earnings per share came in at $2.72, above the expected $2.68, as the company maintained stable performance in its core automotive segment amid broader market weakness.

The communications and infrastructure business saw a steep 27% revenue decline to $320 million, while the industrial and IoT segment dropped 11%. Automotive revenue, which contributes over half of NXP’s total, remained flat but served as a key buffer against softness in other areas.

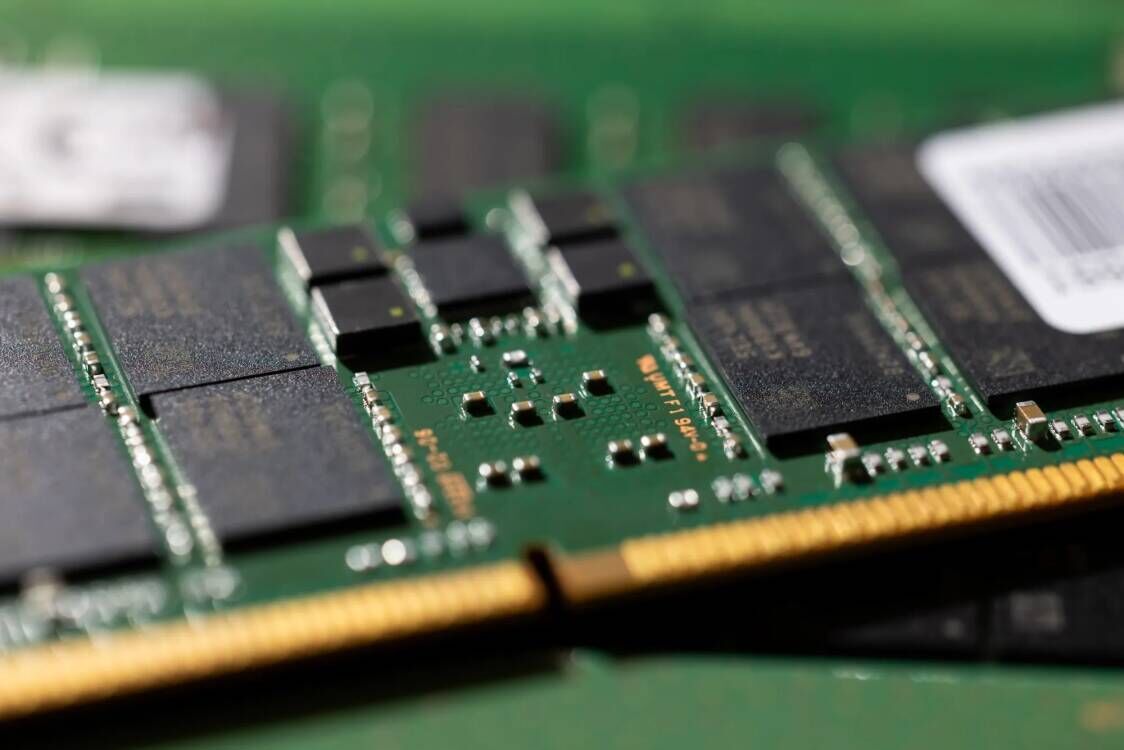

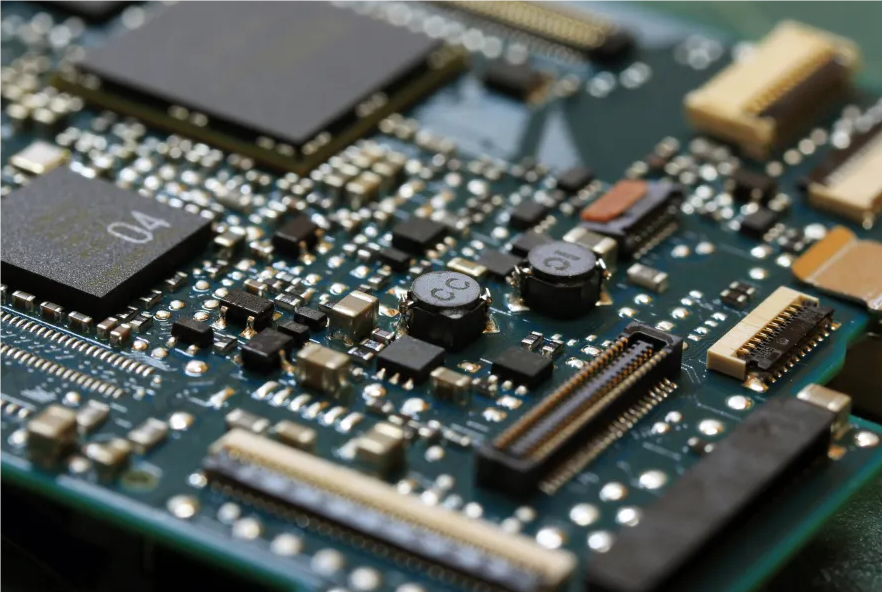

NXP’s chips are widely used in high-speed digital processing across automotive, industrial, telecommunications, and IoT applications. CEO Kurt Sievers previously indicated that Q2 may mark a “turning point” as customer orders begin to stabilize after months of oversupply and uncertainty in global demand.

The company forecasts third-quarter revenue in the range of $3.05 billion to $3.25 billion, with the midpoint slightly exceeding consensus estimates. Despite challenges from tariffs and weaker EV demand outside China, NXP is positioning itself to adapt through strategic product and customer alignment.

All Comments (0)