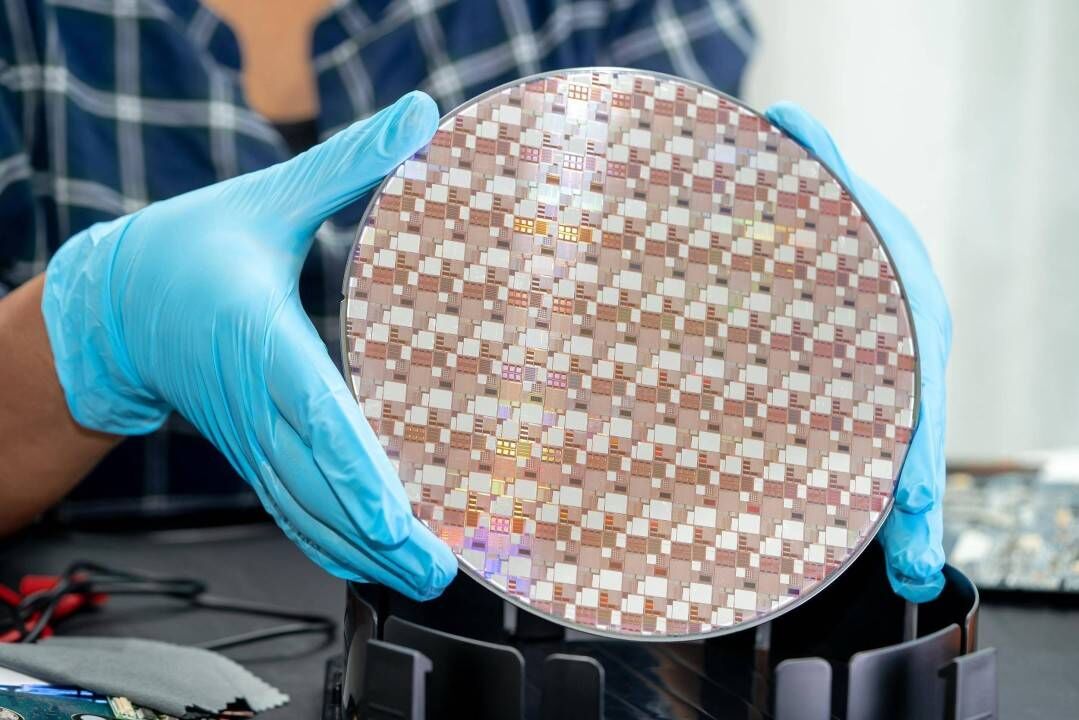

July 21, 2025 /SemiMedia/ — Reports of potential price increases for semiconductor-grade silicon wafers have drawn attention across the industry. However, manufacturers indicate that while downstream demand is gradually improving—particularly driven by AI servers and automotive applications—the overall market remains in a supply-demand balance, and wafer prices are currently holding steady.

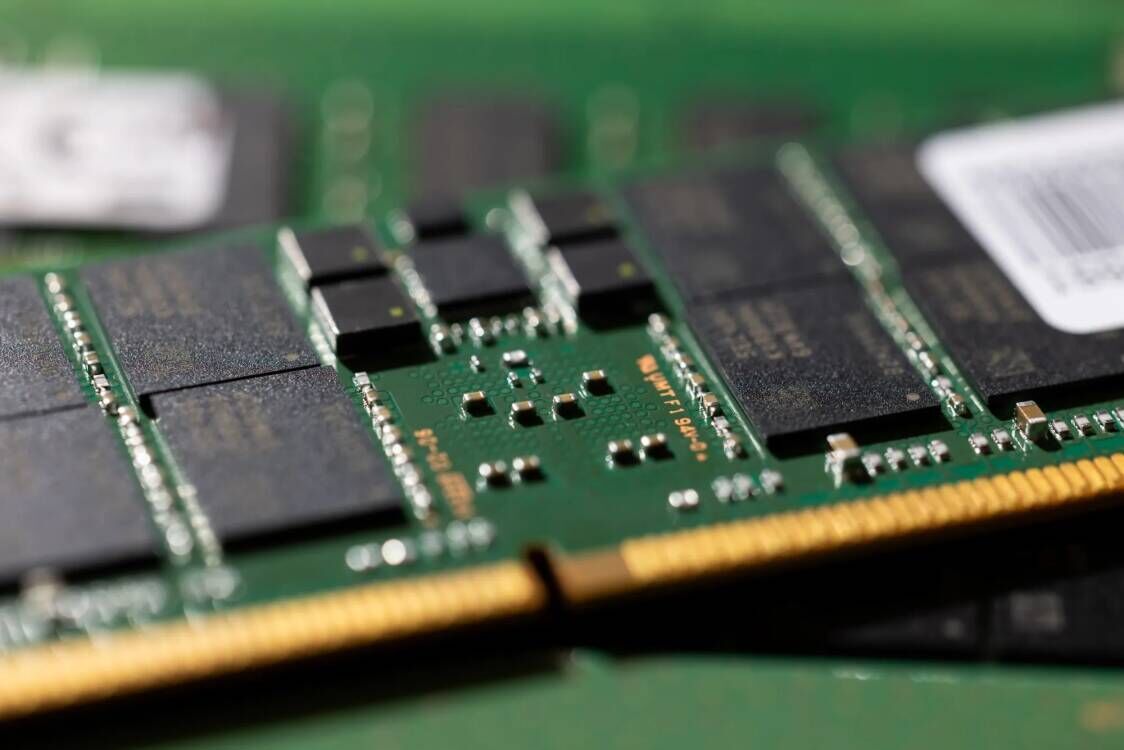

Industry sources note that interest in 12-inch wafers has risen significantly compared to the same period last year, spurred by strategic investments in AI and automotive chips. Despite this uptick in demand, suppliers maintain that existing capacity is sufficient to meet current needs, leaving little room for price adjustments in the short term.

Looking ahead, if demand continues to rise and external pressures—such as tariffs or raw material cost increases—come into play, price renegotiations may become inevitable. Yet any concrete changes will depend on how the market absorbs inventory and whether shipment momentum in the second half of the year meets expectations.

Historically, wafer pricing has been highly sensitive to supply conditions, input costs, and macroeconomic factors. Although there has been no tangible price increase, speculation alone has prompted heightened awareness across the semiconductor value chain.

As a fundamental material in semiconductor fabrication, wafer pricing remains a key variable for chipmakers. With demand from AI and automotive sectors projected to expand, industry players are closely monitoring shifts in supply dynamics and cost structures to adapt to future volatility.

All Comments (0)