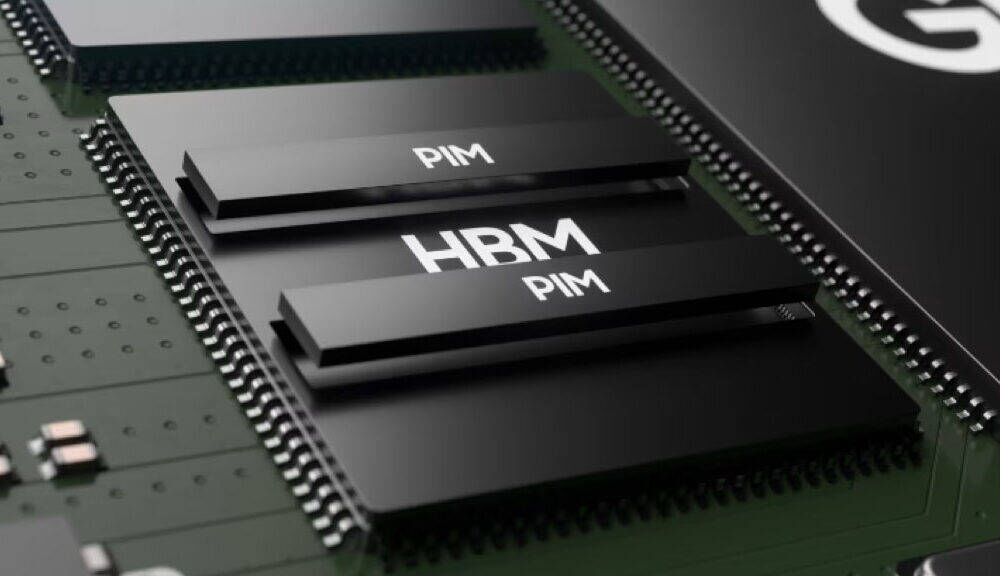

July 21, 2025 /SemiMedia/ — Micron Technology and South Korea’s SK Hynix are facing growing pressure as the high bandwidth memory (HBM) market shows signs of an impending price war, fueled by shifting demand dynamics and Samsung Electronics’ aggressive entry into the segment.

Goldman Sachs analyst Giuni Lee downgraded SK Hynix’s rating from “Buy” to “Neutral” on October 17, citing expectations of a price decline in HBM starting in 2026. Lee noted that pricing power could increasingly shift to a major customer, widely believed to be NVIDIA, and projected a year-over-year drop in SK Hynix’s operating profit for 2025—well below the market’s anticipated 17% increase.

Adding to the bearish outlook, Daishin Securities revised its 2025 HBM average price forecast from a 7% gain to a 6% decline, citing narrowing price advantages for HBM4. As a result, Micron’s shares fell 2.72% to $113.26 on October 17, hitting their lowest level since June 9. SK Hynix shares also plunged 8.95%, closing at KRW 269,500—a four-month low.

SK Hynix is currently the primary HBM supplier for NVIDIA. However, reports from South Korea indicate that Samsung is in advanced talks with NVIDIA to supply 12-layer stacked HBM3E for its upcoming GB300 Blackwell Ultra chips. If Samsung becomes a qualified supplier, NVIDIA would gain leverage in price negotiations with both SK Hynix and Micron.

Industry sources say SK Hynix’s 12-layer HBM3E costs approximately 60% more than the 8-layer version. If Samsung’s HBM passes NVIDIA’s quality tests, it is likely to receive orders as part of a competitive bidding strategy. This pricing pressure may be one reason NVIDIA has delayed its adoption of HBM4.

The escalating competition signals a possible reshuffling of the HBM supply landscape. With Samsung entering a previously duopolistic market, memory makers face not only eroding margins but also the need to re-align pricing strategies to stay competitive in the AI-driven era.

All Comments (0)