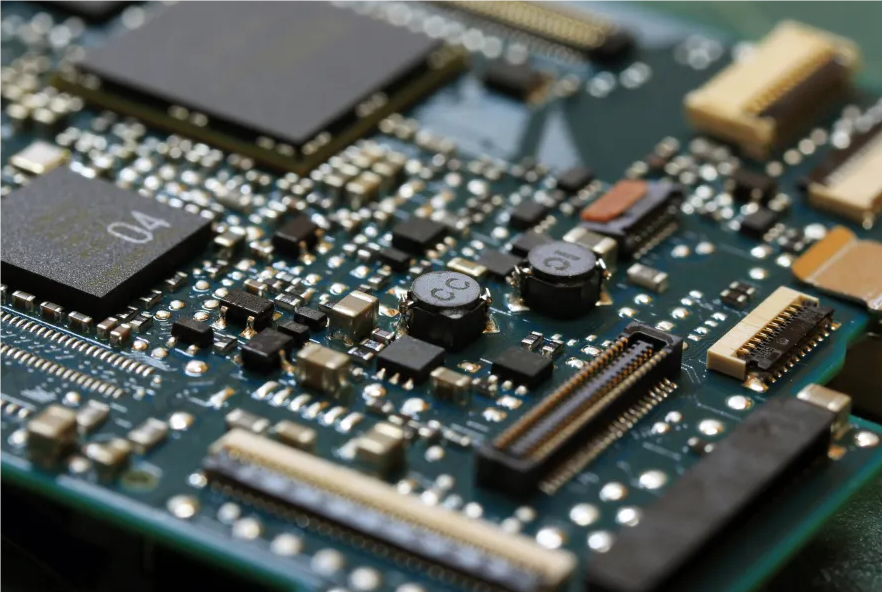

July 24, 2025 /SemiMedia/ — Texas Instruments said on Tuesday that demand for its analog chips remained softer than expected, as the company pointed to ongoing challenges from global tariffs and geopolitical shifts disrupting the semiconductor supply chain.

CEO Haviv Ilan noted that trade policy and geopolitical friction are "disrupting and reshaping global supply chains," while recovery in the automotive sector continues to lag.

The chipmaker forecast third-quarter earnings per share between $1.36 and $1.60 and projected revenue between $4.45 billion and $4.8 billion, both slightly below market expectations. Despite stronger-than-expected second-quarter revenue of $4.45 billion, Ilan said some of the upside may have resulted from customers accelerating orders to hedge against potential tariff changes.

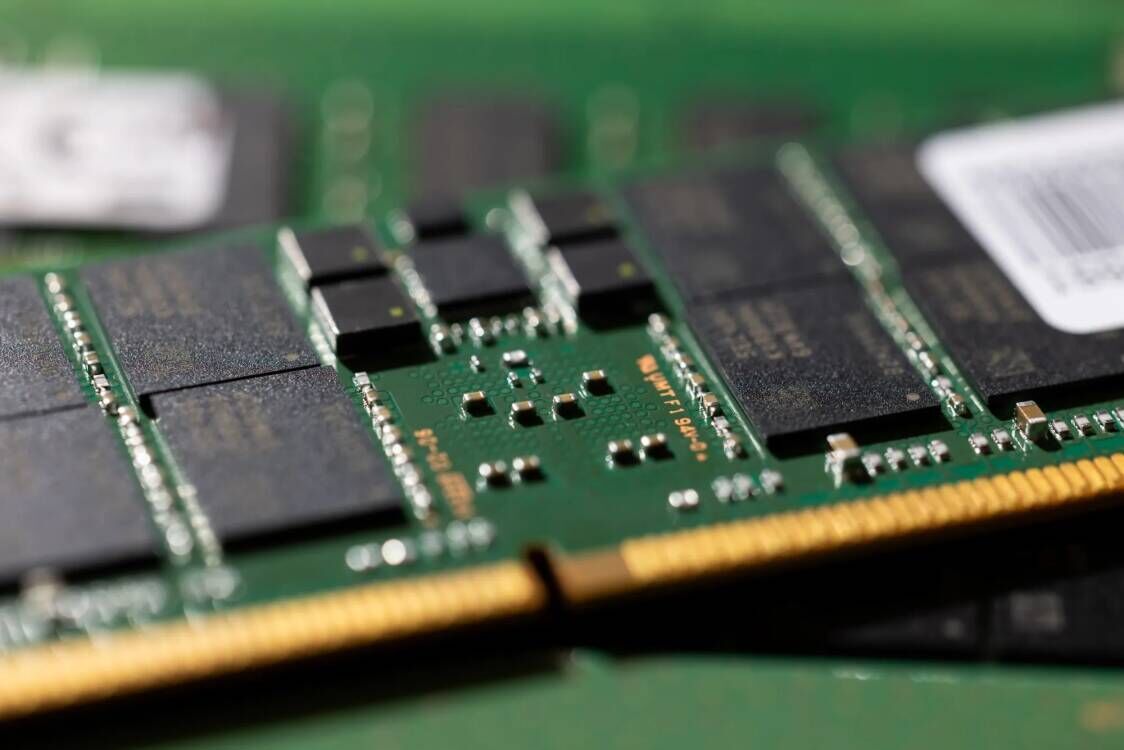

TI is ramping up domestic production by investing more than $60 billion in expanding its 300mm wafer manufacturing capacity in the United States, aiming to improve cost efficiency and reduce reliance on overseas supply chains.

However, factory utilization in the third quarter is expected to remain flat compared to the previous quarter, which could limit gross margin improvement. Chief Financial Officer Rafael Lizardi added that gross margins are likely to remain unchanged, falling short of market projections.

All Comments (0)