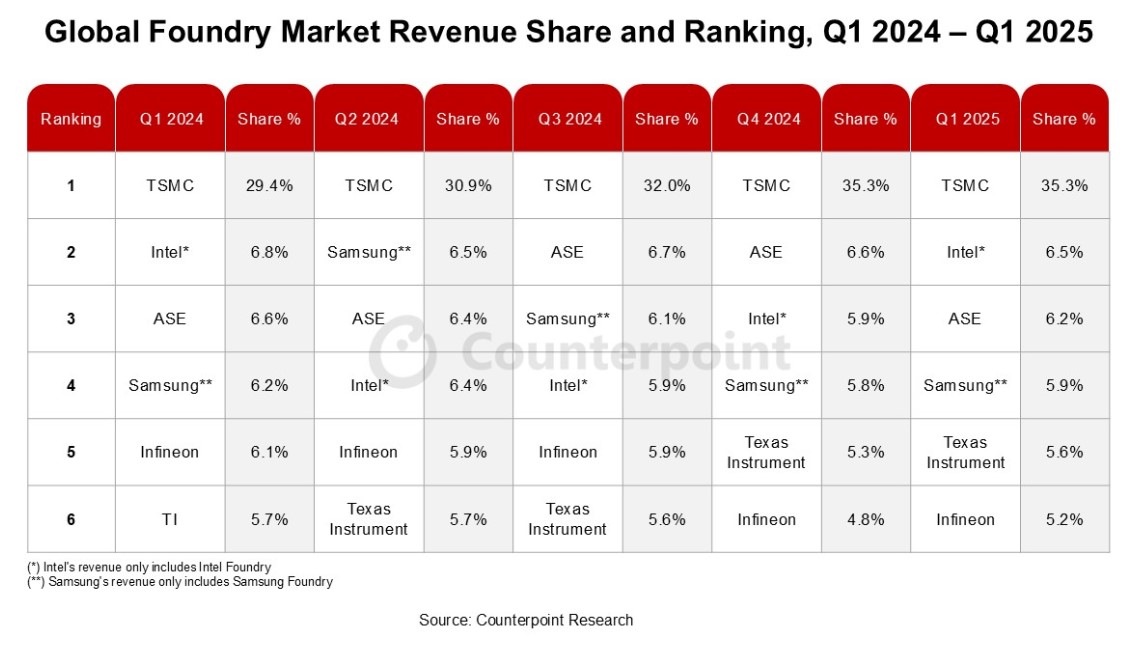

June 25, 2025 /SemiMedia/ — Global semiconductor foundry 2.0 revenue reached USD 72.29 billion in Q1, up 13% year‑on‑year, driven primarily by surging demand for AI and high‑performance computing (HPC) chips, according to Counterpoint Research.

The firm reports that advanced process nodes — 3 nm, 4 nm/5 nm — and sophisticated packaging like CoWoS have been key growth catalysts. “TSMC maintains its leadership, capturing around 35% market share and nearly 30% YoY revenue growth, supported by its strength in advanced process technologies and large AI chip orders,” said Brady Wang, VP at Counterpoint. He added, “Intel’s foundry business is gaining momentum through Intel 18A and Foveros, while Samsung, though developing 3 nm GAA, still faces yield challenges.”

Counterpoint highlights that traditional foundry (foundry 1.0) focused solely on wafer fabrication no longer reflects current industry dynamics. The new foundry 2.0 model, driven by AI trends and system‑level optimization, shifts firms toward full‑stack technology integration. This expanded definition now includes pure‑play foundries, IDM non‑memory fabs, OSATs, and photomask suppliers. In contrast, foundry 1.0 was confined to pure‑play foundry players.

All Comments (0)