June 23, 2025 /SemiMedia/ — U.S. semiconductor company Wolfspeed is preparing to implement a pre‑packaged Chapter 11 restructuring plan with the support of major creditors, including Apollo Global Management, to optimize its capital structure and strengthen its long-term growth in silicon carbide (SiC) semiconductor manufacturing.

The proposed agreement, expected to be announced in the coming weeks, would allow Wolfspeed to streamline liabilities and continue expanding its position in the electric vehicle and power electronics markets. As of March 31, the company reported approximately $6.5 billion in outstanding debt and $1.3 billion in cash.

Sources familiar with the matter said that Wolfspeed aims to secure creditor approval for the plan prior to filing under Chapter 11 of the U.S. Bankruptcy Code. The structure of the deal enables a faster and more efficient resolution process, minimizing business disruption. Under the proposed terms, unsecured suppliers are expected to be repaid in full, while equity holders may retain up to 5%—an outcome rarely seen in similar proceedings.

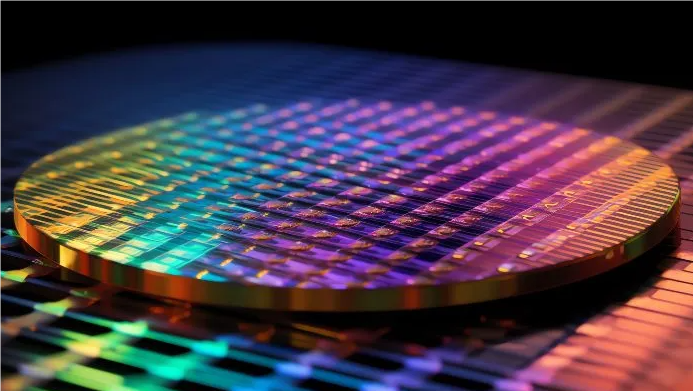

The company continues to advance operations at its key SiC wafer facility and remains committed to fulfilling growing demand in the EV and industrial sectors. Wolfspeed is also in active dialogue with the U.S. government regarding disbursement of a $750 million federal incentive award under the CHIPS and Science Act, of which a portion has already been received.

Renesas Electronics, a key customer and financial partner, previously paid $2 billion as part of a 10-year supply agreement and has been involved in ongoing discussions. In addition, Apollo, together with Baupost Group and Fidelity, has provided financing to support Wolfspeed’s operations, including a $750 million loan in 2024.

Wolfspeed said earlier this year that it had engaged advisors to evaluate various financial strategies to support its continued innovation in SiC technology.

All Comments (0)