April 14, 2025 /SemiMedia/ — STMicroelectronics has announced further details of its global manufacturing transformation strategy, originally outlined in October 2024. This initiative is designed to enhance competitiveness, streamline the company’s global operations, and reinforce the long-term sustainability of its Integrated Device Manufacturer (IDM) model by leveraging strategic technology, R&D, design, and high-volume manufacturing assets across key regions.

“Our goal is to future-proof our IDM model by strengthening our European assets and accelerating innovation,” said Jean-Marc Chery, President and CEO of STMicroelectronics. “We’ll redefine site missions to support long-term success while maintaining a responsible, voluntary transition process. Italy and France will remain central hubs for R&D and high-volume manufacturing with continued investment in mainstream technologies.”

Strategy: Efficiency and Innovation

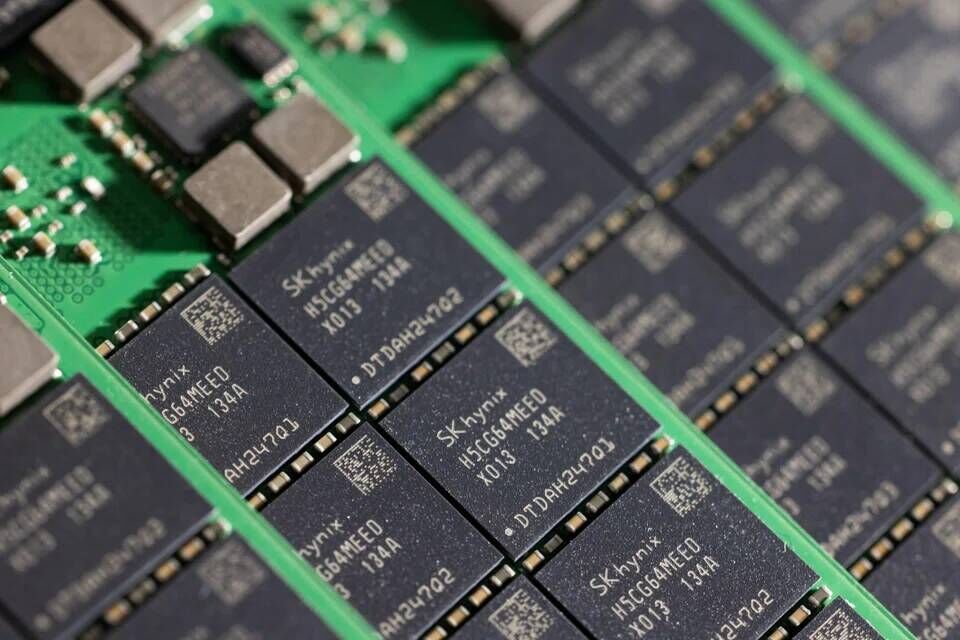

ST’s evolving strategy prioritizes high-yield investments in 300mm silicon and 200mm silicon carbide wafer fabs, while improving the efficiency of 150mm and legacy 200mm capabilities. Upgrades across the value chain will incorporate AI and automation to enhance R&D, manufacturing, and quality assurance with a focus on sustainability.

Regional Ecosystems for Specialized Manufacturing

Over the next three years, ST will enhance regional manufacturing ecosystems:

- France: Digital technologies

- Italy: Analog and power solutions

- Singapore: Mature process nodes

All current sites will continue to serve long-term roles within ST’s global framework.

Scaling 300mm Megafabs in Agrate and Crolles

- Agrate (Italy): Targeting 4,000 wafers/week capacity by 2027, with scalable expansion up to 14,000 wafers/week. The 200mm fab will focus on MEMS.

- Crolles (France): Will grow to 20,000 wafers/week and introduce electrical wafer sorting and advanced packaging, focusing on next-gen technologies like optical sensing and silicon photonics.

Catania: Power Electronics Competence Center

Catania will remain a center of excellence for power and wide-bandgap semiconductors. Production of 200mm SiC wafers is on track to begin in Q4 2025. GaN-on-Si and silicon power device manufacturing will also be prioritized.

Additional Site Optimizations

- Rousset (France): Focus on 200mm manufacturing with reallocated volumes.

- Tours (France): Continue 200mm production, phase out 150mm, and focus on GaN epitaxy and chiplet panel-level packaging.

- Ang Mo Kio (Singapore): Central hub for legacy 150mm and mature 200mm processes.

- Kirkop (Malta): Upgraded test and packaging with advanced automation.

Workforce Adaptation

ST will shift workforce capabilities towards automation and process control. Up to 2,800 employees are expected to exit voluntarily by 2027. The company is committed to constructive social dialogue and will provide regular updates.

All Comments (0)