August 14, 2024 /SemiMedia/ -- According to reports, recent industry data and executive comments show European automotive chip manufacturers' deep dependence on the Chinese market. According to analysis, leading European chip companies such as NXP and Infineon derive a significant proportion of their revenue from China. This trend is particularly prominent in the context of the rapid development of the global electric vehicle market.

Kurt Sievers, CEO of NXP Semiconductors, highlighted the "astonishing growth" in EV sales in China when contrasting the sluggish performance of industrial markets in Europe and the Americas. His observation underscores the robust momentum in China, which serves as the world's largest EV market. Similarly, Jochen Hanebeck, CEO of Infineon, noted that while a full recovery in the global EV market remains elusive, China's resilience has contributed to profitability for the company.

Texas Instruments (TI) has also benefited from China, with all five of its product segments experiencing growth rates as high as 20% in the country. This underscores the vital role that China plays in the global semiconductor landscape.

McKinsey's forecast further reinforces this trend, predicting that the automotive chip market will reach a staggering $150 billion by 2030. As a strength of Europe in the semiconductor industry, the expansion of automotive chips is fueled by increasingly complex technologies that are transforming vehicles, especially EVs, into computers on wheels. Infotainment systems, autonomous driving capabilities, and safety features now heavily rely on these tiny electronic components.

China, as the world's largest producer and market for EVs, wields significant influence. Shenzhen-based BYD reported a record 340,800 passenger vehicle deliveries in July, a 31% year-on-year increase. However, Chinese manufacturers rely heavily on foreign companies for various chips needed for modern high-end vehicles, including sensors, power management chips, and microcontroller units (MCUs), which are essentially small computers used for functions like braking.

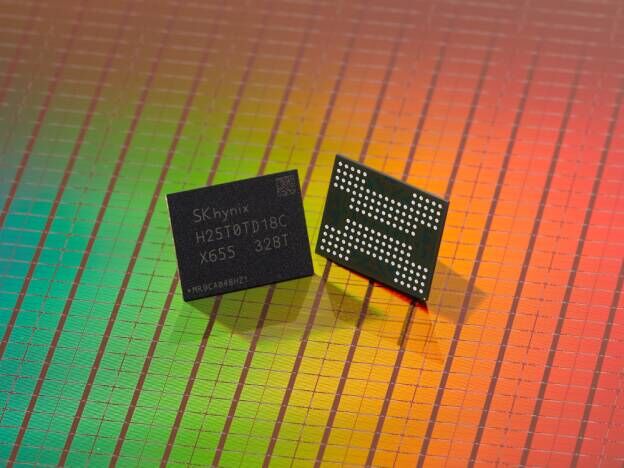

Research indicates that Chinese automotive chip manufacturers can currently only meet about 10% of domestic demand. This supply gap presents a significant opportunity for European chip giants like Infineon, NXP, and STMicroelectronics, each generating approximately one-third of their revenues from China. Additionally, Renesas Electronics and TI also have notable shares of around 25% and 20%, respectively.

It is worth noting that researchers at Rhodium Group pointed out in a report in May that European automotive chip manufacturers are gradually deepening their cooperation with Chinese companies. This strategy is similar to the layout of German automakers in the Chinese market and is seen as an "insurance policy" to ensure stable supply in the Chinese market. This trend not only reflects the importance of the Chinese market, but also indicates that China and Europe will have closer cooperation in the semiconductor field in the future.

All Comments (0)