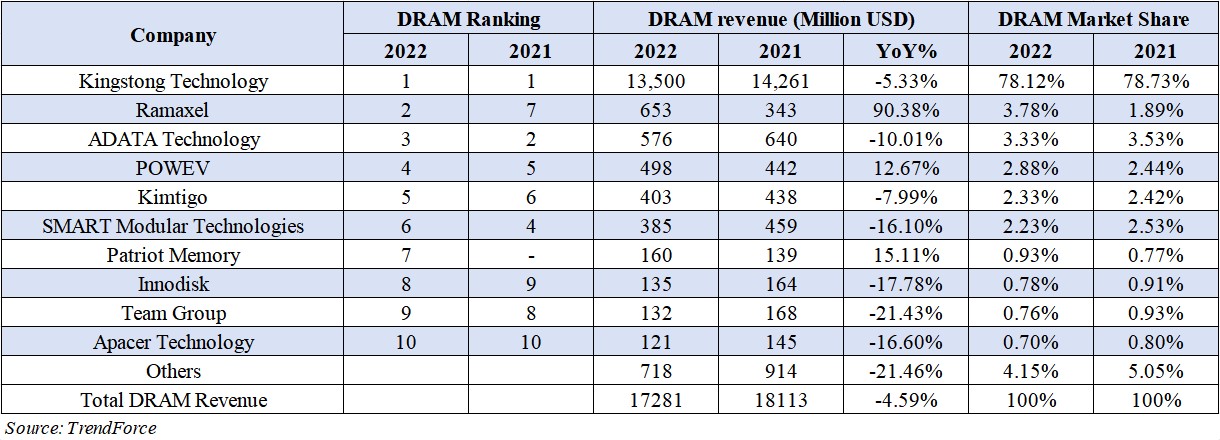

October 27, 2023 /SemiMedia/ -- According to TrendForce, the overall global DRAM module market sales in 2022 were US$17.3 billion, a decline of 4.6%, with Kingston ranking first with a market share of 78%.

In the overall sales of memory modules in 2022, the top five suppliers accounted for 90% of the market, and the top ten accounted for 96%. Despite poor end-market demand, Kingston's brand scale and complete product supply chain allowed its sales to decrease by only 5.3% in 2022, ranking first in the market.

Ramaxle, which ranked second, has made great achievements in the server field, improving its ranking by 5 places compared with 2021, with a market share of 3.78%. ADATA ranks third with a market share of 3.33%. The company's products are mainly targeted at the consumer market, while high-margin products such as industrial control, automotive, and e-sports account for a lower proportion.

POWEV benefited from its gains in the e-sports market, driving DRAM's revenue in 2022 to US$498 million, an increase of 12.7%, and its ranking rose to fourth place. In addition, Kimtigo ranked fifth with DRAM revenue of US$403 million.

In addition, the manufacturers ranked sixth to tenth are SMART Modular Technologies, Patriot Memory, Innodisk, Team Group, and Apacer.

All Comments (0)