According to the latest report from IC Insights, total semiconductor sales will rise 11% this year following a very strong 25% increase in 2021 and an 11% increase in 2020. If achieved, it would mark the first time since 1993-1995 that the semiconductor market has enjoyed three consecutive years of double-digit growth.

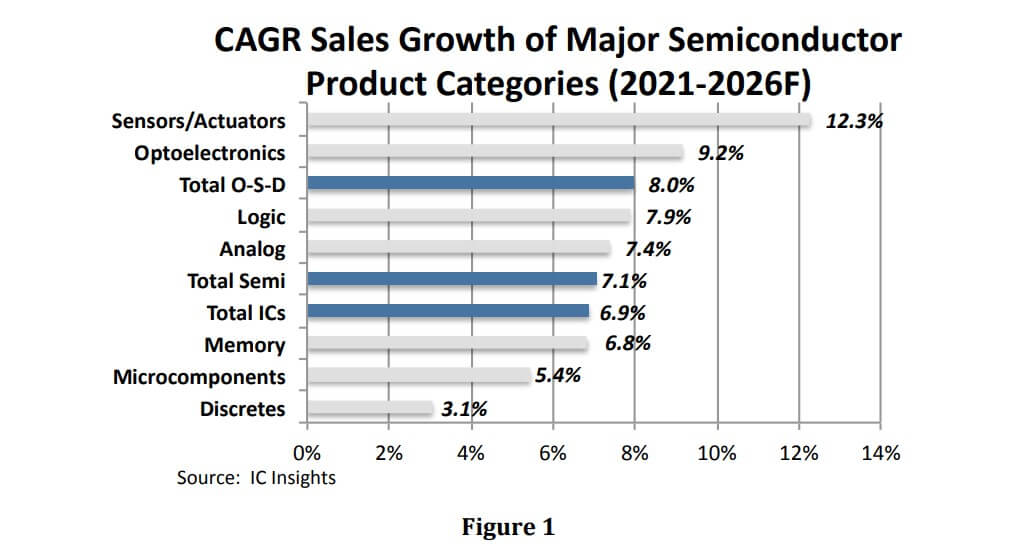

IC Insights pointed out that from 2016-2021, the compound annual growth rate (CAGR) for the total semiconductor market was 11.0%—a very strong period that included a big surge in DRAM and flash memory markets in 2017 and 2018 and strong post-Covid recovery in 2020 and 2021. However, most industry observers realize that the semiconductor industry is very cyclical and ongoing annual double-digit gains are unsustainable. As a result, IC Insights now forecasts total semiconductor sales will rise over the next five years at a more moderate compound annual growth rate of 7.1% (Figure 1).

The 2021-2026 CAGR for total opto, sensor, discretes (O-S-D devices) is projected to rise at a healthy rate of 8.0% and total IC sales are expected to increase at a slightly lower pace of 6.9%. CAGRs among major semiconductor product categories are forecast to range from a high of 12.3% for sensors/actuators to 3.1% for discretes.

The sensors/actuators market ($24.3 billion forecast in 2022) represents the smallest major product segment within the semiconductor market, accounting for less than 4% of sales. However, throughout the forecast period, sensor sales are expected to increase significantly in automobiles, cellphones, and portable and wearable systems (e.g., smartwatches and fitness/activity trackers). In addition, more systems are using multiple sensors and sensor fusion software for multi-dimensional measurements to support greater machine intelligence and the ability to recognize movement, know locations, and monitor changes in the surrounding environment.

Among the major IC categories, the logic IC market has the highest CAGR, according to IC Insights forecasts. The logic IC market has performed very well in recent years, with automotive—special purpose logic and industrial— special purpose logic devices serving as strong drivers for overall growth in this segment.

All Comments (0)