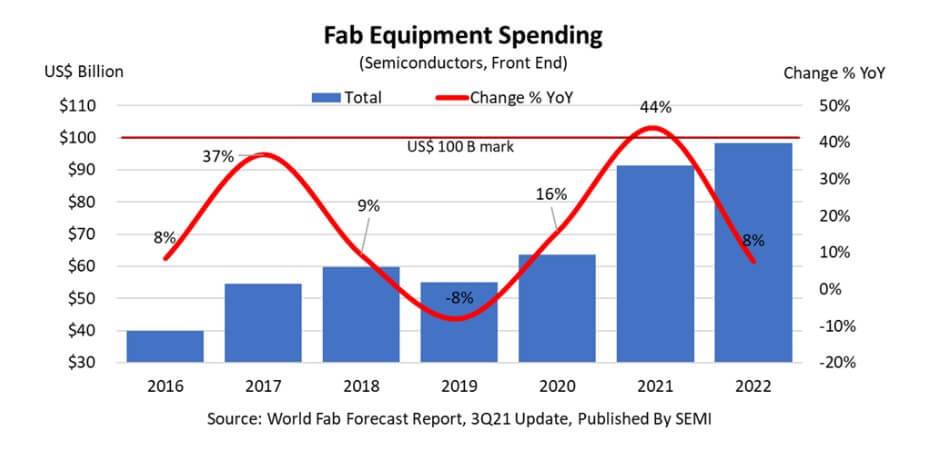

According to the latest report from SEMI, driven by digital transformation and other secular technology trends, global semiconductor equipment investments for front end fabs in 2022 are expected to reach nearly US$100 billion to meet soaring demand for electronics after topping a projected $90 billion this year, both new records.

SEMI pointed out that the new fab equipment spending records will mark a rare three consecutive years of growth that began in 2020, bucking the historical cyclical trend of a one- or two-year expansion followed by a year or two of tepid growth or declines. The semiconductor industry last saw more than two consecutive years of growth in the mid-1990s.

The SEMI report stated that the foundry sector will account for the bulk of fab equipment investments in 2022, with more than US$44 billion in spending, followed by the memory sector at over US$38 billion. Both DRAM and NAND also show large increases in 2022 with jumps in spending to US$17 billion and US$21 billion, respectively. Micro/MPU investments will reach approximately US$9 billion, discrete/power US$3 billion, analog US$2 billion, and other devices about US$2 billion next year.

SEMI concluded that in 2022, Korea will lead in fab equipment spending at US$30 billion, followed by Taiwan region at US$26 billion, and Mainland China at nearly US$17 billion. Japan will take the fourth spot with almost US$9 billion in fab equipment spending. While Europe/Mideast will be in fifth place at US$8 billion, the region is expected to post standout year-over-year percentage growth of 74% in 2022. In the Americas and Southeast Asia, spending is projected to reach more than US$6 billion and US$2 billion, respectively.

All Comments (0)