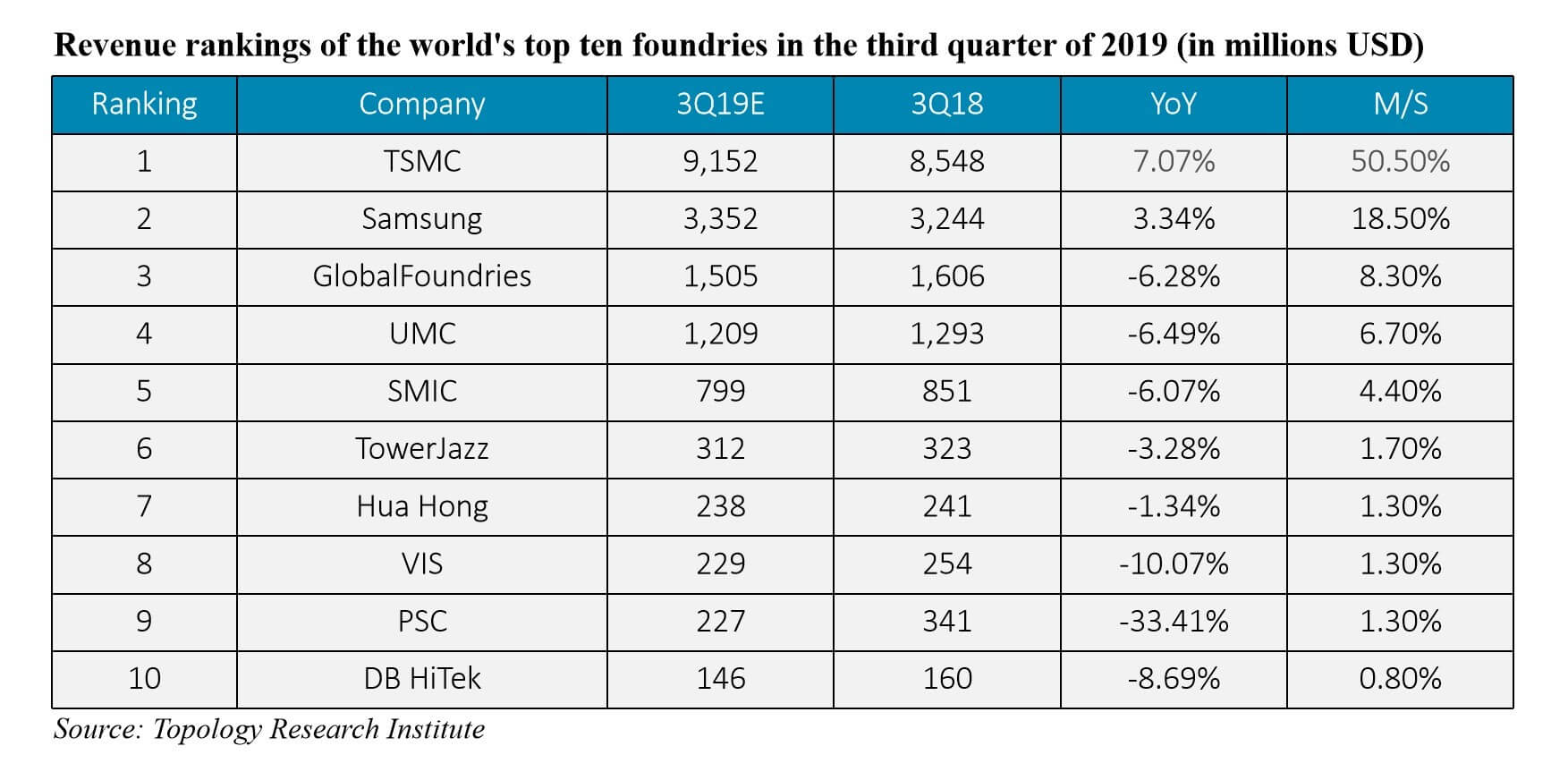

According to the latest report released by Topology Research Institute, with the arrival of the electronics industry peak season, the demand for semiconductor devices will increase from the first half of the year. It is estimated that the global wafer foundry output in the third quarter will grow 13% compared with the second quarter. . In terms of wafer foundry rankings, TSMC ranked first with a market share of 50.5%, followed by Samsung with 18.5% and the third is GlobalFoundries, with a market share of 8%.

However, Topology said that due to the trade war between China and the United States, consumer market demand is lower than the same period in 2018, and the rebound of the semiconductor industry in the second half of the year may not be as strong as expected.

According to Topology, TSMC's 7-nm node customers include Apple, HiSilicon, Qualcomm, AMD, etc, the 7-nanometer process capacity utilization rate is almost full. Together with the demand from other customers, the overall annual growth is estimated to be 7%.

Samsung is still growing in the foundry industry with the demand for its own electronic products and the needs of other customers. At present, most of the smart phones on the market use the Qualcomm 5G modem chip X50 produced by Samsung's 10nm process, which will drive Samsung's revenue this quarter to grow by about 3.3% compared with the same period last year.

As for GlobalFoundries, after the sale of the plant and chip business, it received stable orders from its buyers, in addition, it also increased revenue from communications by RF-SOI technology. However, the overall revenue of GlobalFoundries may be reduced after the handover of the factories. In addition, AMD's development of the 7nm production line may also affect GlobalFoundries' revenue.

Topology pointed out that in terms of the overall foundry market, due to the recent trade war between China and the United States, the two sides are mutually restrained on tariffs, and the United States continues to include Huawei-related enterprises in the entity list, the Huawei ban may not be lifted in the short term. Under this circumstance, it is estimated that the market demand for electronic products such as mobile phones, notebook, tablet, and televisions will be affected in 2019, which will lead to a decline in the business of wafer foundries. Therefore, its view on demand in the second half of the year tends to be conservative.

All Comments (0)