According to reports from Morgan Stanley and JP Morgan Chase, the market for passive components will not be stable until the second quarter. If the inventory structure cannot be optimized, the second half of the year may continue to decline.

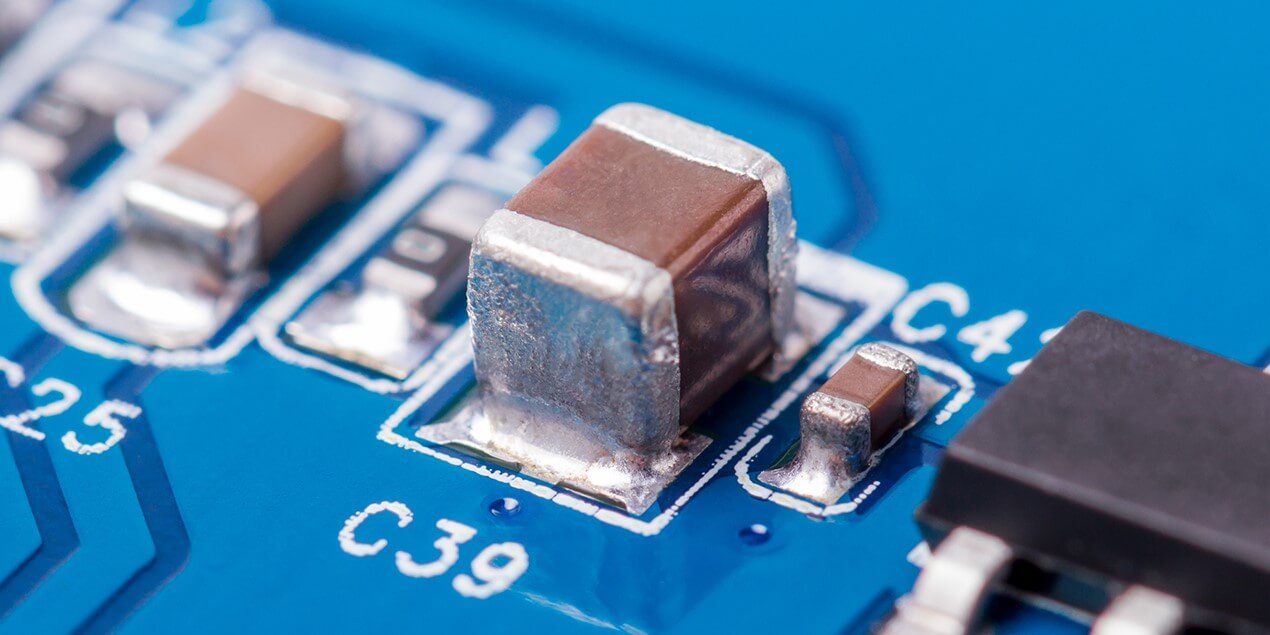

According to analysts' surveys, Yageo's MLCC price has dropped this year. It is estimated that prices will fall by 10% to 20% in the first quarter, and the second quarter will continue to fall.

In this context, this year's full-year performance decline may be inevitable. However, starting this year, Pulse Electronics' revenue will be merged into Yageo's earnings report, and the electronics industry's peak season in the second half of the year will still have the opportunity to push up demand, which may reduce the recession.

After Yageo's acquisition of Pulse, it will gradually enter the high-end automotive MLCC market. In addition to the current leading position of the middle and low-end MLCC, Yageo's future growth space is still very large.

All Comments (0)