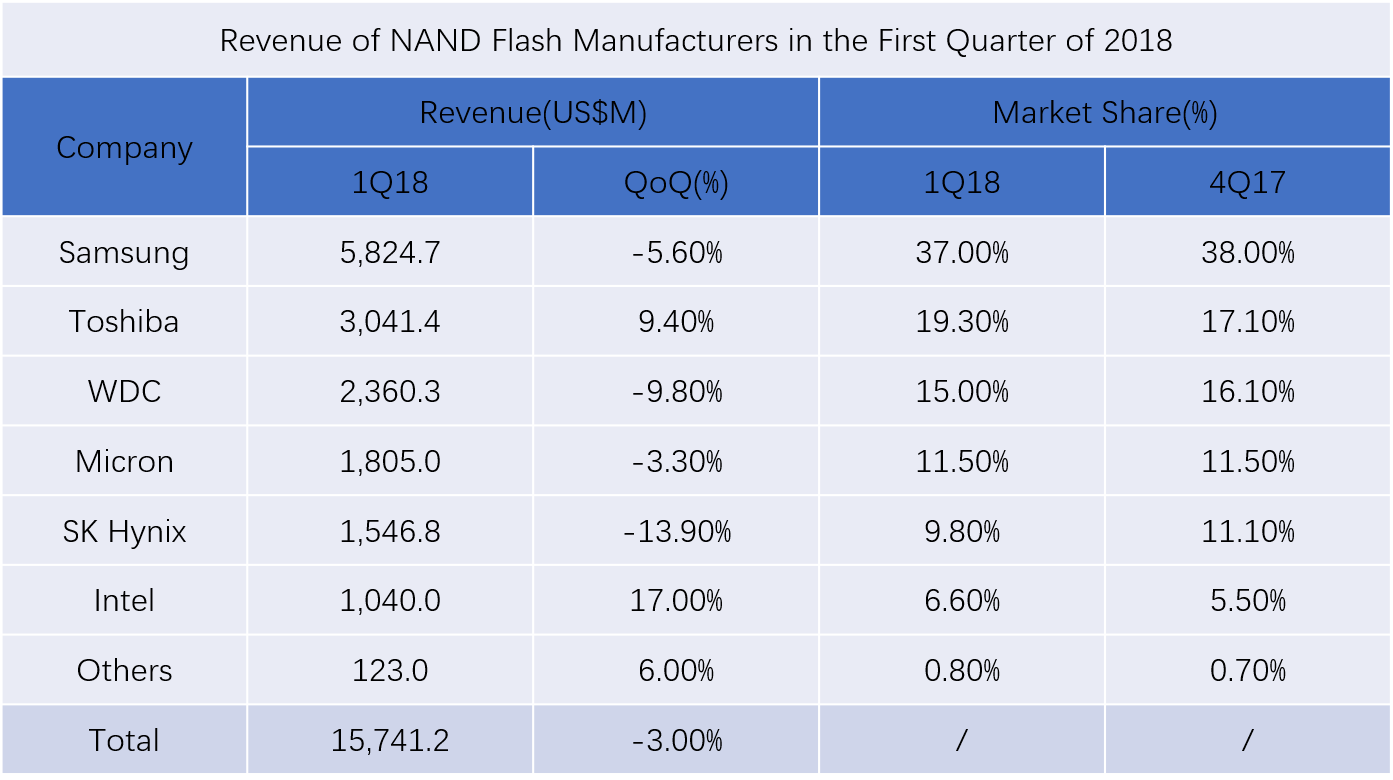

DRAMeXchange, a global market research organization, said that in the first quarter of 2018, demand entered the off-season cycle, which caused prices to float downward. The NAND Flash brand revenue fell by 3% in the first quarter. In the second quarter, the market was still in a state of oversupply, eMMC/ Contract prices such as UFS and SSD continued to decline, but suppliers hope to stimulate the growth of medium- and high-capacity products such as 256GB SSD and 128/256GB UFS through more attractive quotations. Therefore, it is expected that the revenue performance of various suppliers will maintain stable.

Looking forward to the second half of the year, in the traditional peak season, Apple’s demand for new mobile phone will help boost the NAND Flash market price volatility back to a more stable state. In fact, NAND Flash's demand growth has been suppressed for nearly a year due to the previous high price shock. The current price trend helps OEMs adopt higher-capacity products in PCs, smart phones and other new generation products, and continue to drive NAND Flash demand a steady growth.

Samsung Electronics

In the first quarter, as the demand for servers, data centers, and smart phones were affected by the off-season impact, Samsung’s sales volume fell slightly, and after the prices of products such as Client and Enterprise SSD floated downward, the first quarter revenue was higher. The quarter fell 5.6% to 5.82 billion U.S. dollars.

In the first quarter, due to the impact of smart phone off-season, SK Hynix bit shipments decreased by nearly 10% quarterly, and the average sales unit price was supported by the eMCP contract price, although only a 1% quarterly decrease, but the overall revenue It was US$1.55 billion, down 13.9% from the previous quarter. The main sales force of SK Hynix is NAND Flash and MCP on mobile phones. Although the demand for smartphones fell in the first quarter, as China’s smartphones upgraded their high-end models from 64/128GB to 128/256GB, and the second quarter At the end of the apple stocking demand started, it is expected that SK Hynix will still have stable sales performance in the second quarter.

Although the first quarter was affected by the off-season of smart phones, Toshiba benefited from the start of shipments of 64-layer 3D-NAND Flash wafers to various module factories, which resulted in a slight increase in overall shipments, and stocking at the module plant Wafer as well as SSDs. When the average shipment capacity grew, the average sales unit price grew by nearly 10%, and the overall revenue came to US$3.04 billion, which was a growth of 9.4% from the previous quarter. It is worth mentioning that the Toshiba Semiconductor M&A case was approved by the Chinese anti-monopoly review on May 17 and is expected to be completed on June 1.

Western Digital

The first quarter was affected by the traditional off-season and the decline in shipments of notebook PCs and server SSDs. Shipments in the first quarter of Western Digital dropped by more than 5% quarter-to-quarter. In terms of retail sales, although multi-brand strategies continued to work, the products Prices were still falling due to oversupply of NAND Flash and the impact of inventory adjustments in the first quarter. The average selling unit price fell by nearly 5%, making NAND Flash revenue in the first quarter of the Western Digital reached US$2.36 billion, down 9.8% from the previous quarter.

Micron

With the change of sales strategy, Micron gradually shifted its focus from the original channel market players and Wafer to shipping their own branded products. The sales performance of SSD products was very bright this season, and the overall bit shipment also grew by over 10%. %, however, due to the significant decline in channel SSD and 3D-NAND TLC Wafer prices in the first quarter, the average selling unit price fell by nearly 15%. Under mutual offset, Micron’s first-quarter revenue was US$1.81 billion, compared with the previous quarter. Declined by 3.3%.

Intel

With continued growth in server SSD momentum, Intel's first-quarter bit shipments grew by nearly 30%. The average sales unit price fell by about 10% due to market price corrections. Intel’s first-quarter revenue reached US$1.04 billion. It grew 17% last quarter.

All Comments (0)