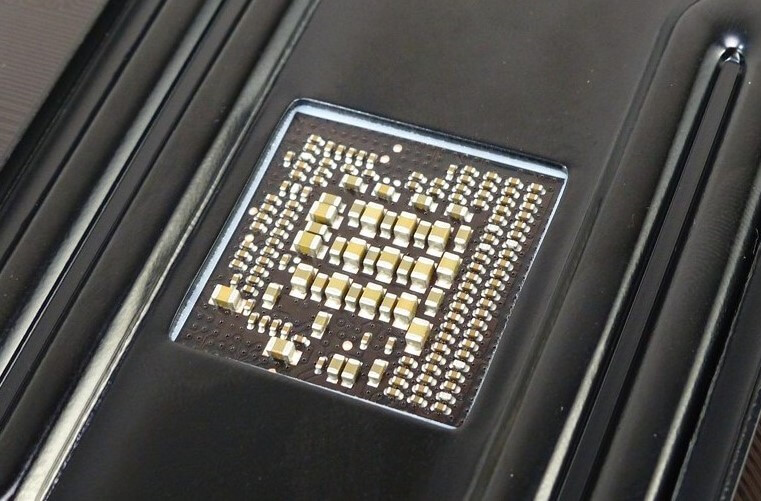

According to sources from the passive component industry, due to the impact of COVID-19, the demand for electronic components has been sluggish recently. However, the MLCC market has shown the opposite trend of high demand.

The industry said that there are three reasons for the positive trend of MLCC. First, before the COVID-19 epidemic, the overall MLCC inventory in the industry was low. As Chinese OEM / EMS customers resumed production, demand rebounded, which accelerated the consumption of inventory.

Secondly, the COVID-19 has driven the demand for applications such as tablets, laptops, and network communications. These electronic products need to use a large number of MLCCs, which is an important driving force for MLCC demand.

Third, the Philippines and Malaysia implemented city lockdown in response to the COVID-19 pandemic, which caused passive parts makers such as Murata, Samsung, Walsin, and Ralec to close their factories in these two countries, leading to a sharp decline in MLCC and resistor supply.

According to industry analysis, Murata, Samsung, and Taiyo Yuden's MLCC capacity in the Philippines accounted for 15%, 40%, and 25% of each company. In addition, Ralec and Walsin also have factories in Malaysia. Therefore, the Lockdown in the Philippines and Malaysia has brought a tightening effect on global supply, causing a large number of orders to shift to Yageo, which has China as its main production base.

According to Yageo's revenue share in the fourth quarter of last year, communications, PCs, and laptops accounted for more than 50% of its total sales. In addition, Yageo raised prices after early March. Therefore, Yageo's revenue from March will show a strong upward trend.

All Comments (0)