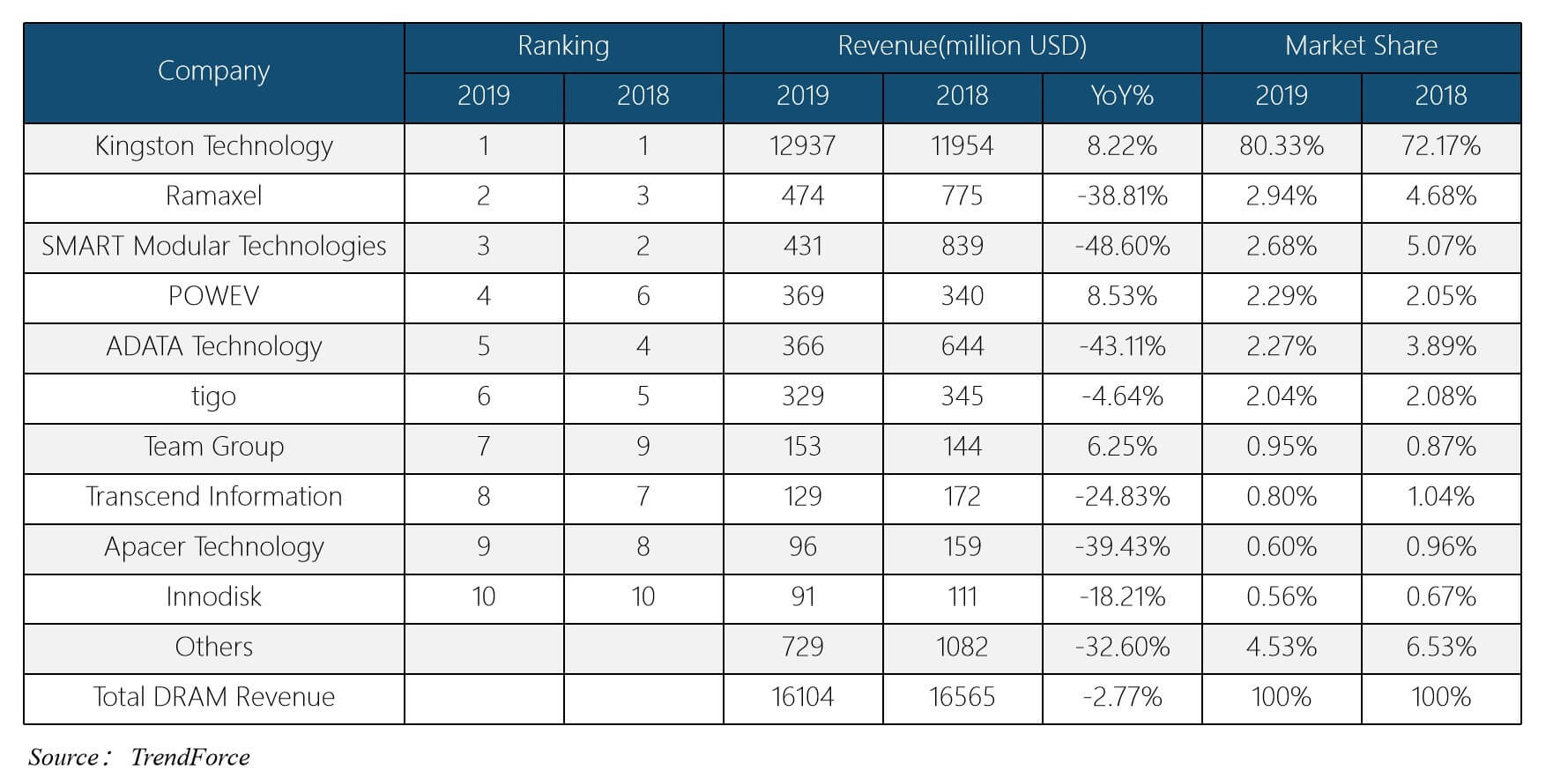

According to a report released by the market research organization TrendForce, DRAM prices dropped sharply in 2019, with a cumulative decline of more than 50% throughout the year.

The decline in DRAM prices has led to a decline in revenue for most memory module makers in 2019. However, due to Kingston's counter-trend growth, the overall global module market in 2019 reached 16.1 billion U.S. dollars, a year-on-year decrease of only 3%.

Looking back at the price trend in 2019, TrendForce pointed out that due to the large inventory of customers and DRAM suppliers at the end of 2018, and the weakening of purchasing momentum, DRAM prices fell rapidly in the first half of 2019. In addition, customers spent a year to consume inventory, making DRAM prices continue to decline throughout the year, affecting most memory module manufacturers. However, despite the bad market, there are still a small number of module factories to open up new business opportunities, driving the performance to rise against the trend.

According to TrendForce's statistics, the world's top five memory module manufacturers accounted for 90% of overall sales in 2019, and the top ten already accounted for 95% of the global module market's turnover.

It is worth mentioning that Kingston’s market share has reached more than 80%. Last year, it developed a new business model that drove it to grow against the trend when DRAM prices fell, making it once again ranked first with an annual revenue increase of 8%.

All Comments (0)