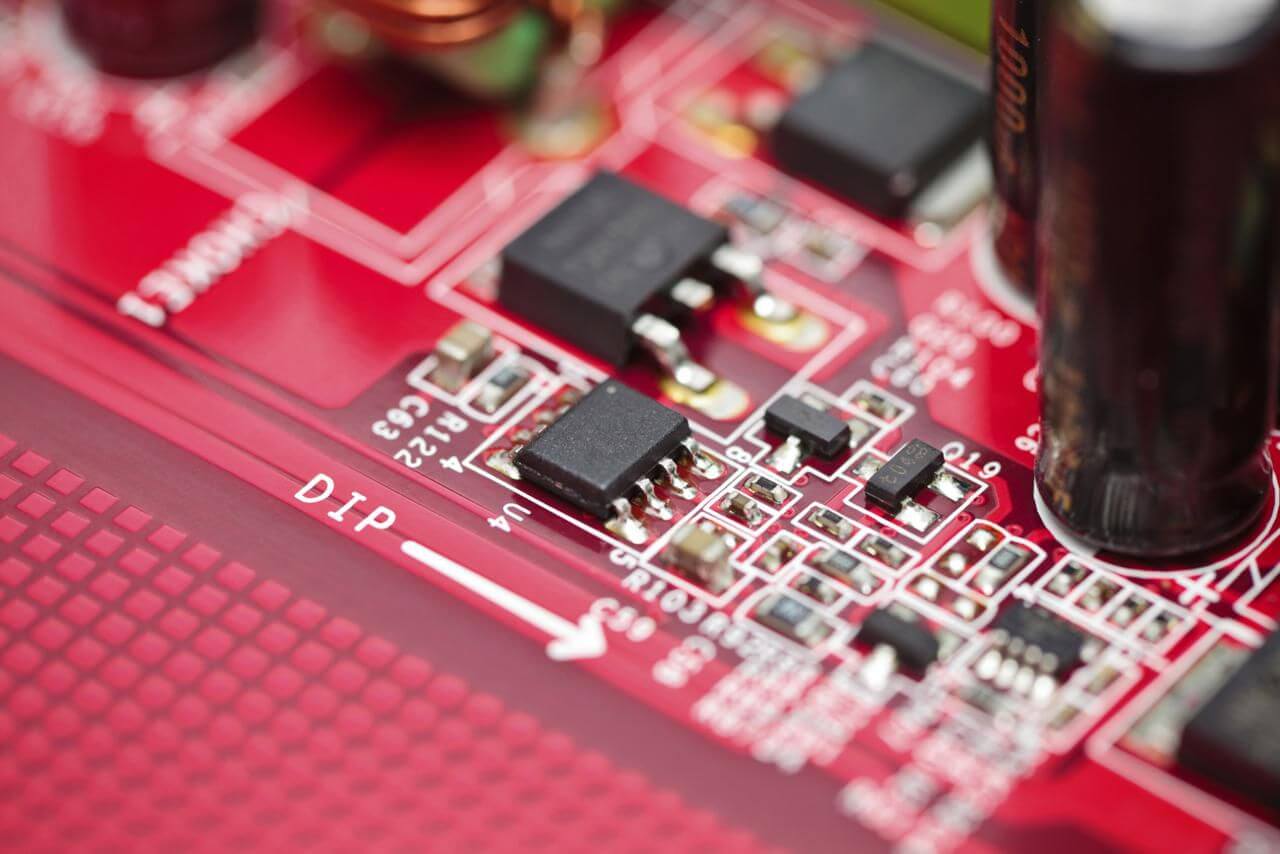

According to Gartner's latest report, due to the impact of COVID-19 on semiconductor supply and demand, global semiconductor revenue is expected to decline by 0.9% in 2020.

The report points out that, 2020 global semiconductor revenue has been reduced from the previous quarter’s forecast by $55 billion, to $415.4 billion. 2020 total market growth has been reduced from 12.5% to a decline of 0.9%, with nonmemory expected to decline 6.1%, while memory is forecast to grow 13.9%.

By 2020, memory chip market revenue will account for 30% of the global semiconductor market, reaching 124.7 billion US dollars, an increase of 13.9%, while non-memory market revenue is expected to reach $290.6 billion, down 6.1% year-on-year.

In the memory market, NAND flash memory revenue is expected to grow by 40% in 2020, and prices remain stable. Richard Gordon, vice president of research at Gartner, said that due to delays in chip fabs and technological transformation, the supply of NAND flash memory will remain at a historically low level in 2020, but demand will decrease later in 2020.

Strong demand from cloud service providers in the first half of 2020 will drive up the price and revenue of server DRAM. However, weak demand and falling smartphone market prices will completely offset this growth. Gartner analysts predict that the overall revenue of the DRAM market will drop by 2.4% in 2020.

“Non-memory semiconductor markets will experience a significant reduction in smartphone, automobile and consumer electronics production and be heavily impacted across the board,” said Mr. Gordon. “In contrast, the hyperscale data center and communications infrastructure sectors will prove more resilient with continued strategic investment required to support increased remote working and online access.”

All Comments (0)