On November 28th, Yageo's acquisition of the USPulse Electronics case has passed the review of China's anti-monopoly declaration, and has reached relevant anti-monopoly declaration, review and preconditions, and will be handed over according to regulations. The delivery date is December 3 and is expected to be incorporated into Yageo in January next year.

Yageo said that after the acquisition of Pulse Electronics by Pluto Merger Corporation, a 100%-owned subsidiary in May, it has passed anti-monopoly reviews in various countries, including Germany and Austria, the anti-monopoly declaration in mainland China has also passed the review in mid-November.

Yageo further stated that in accordance with the provisions of the contract, after the relevant anti-monopoly declaration, review and the achievement of preconditions, both parties need to make delivery. The estimated delivery base date is December 3, local time in the United States. In accordance with the regulations, Yageo increased the capital of Pluto with US$740 million to pay for the completion of the delivery.

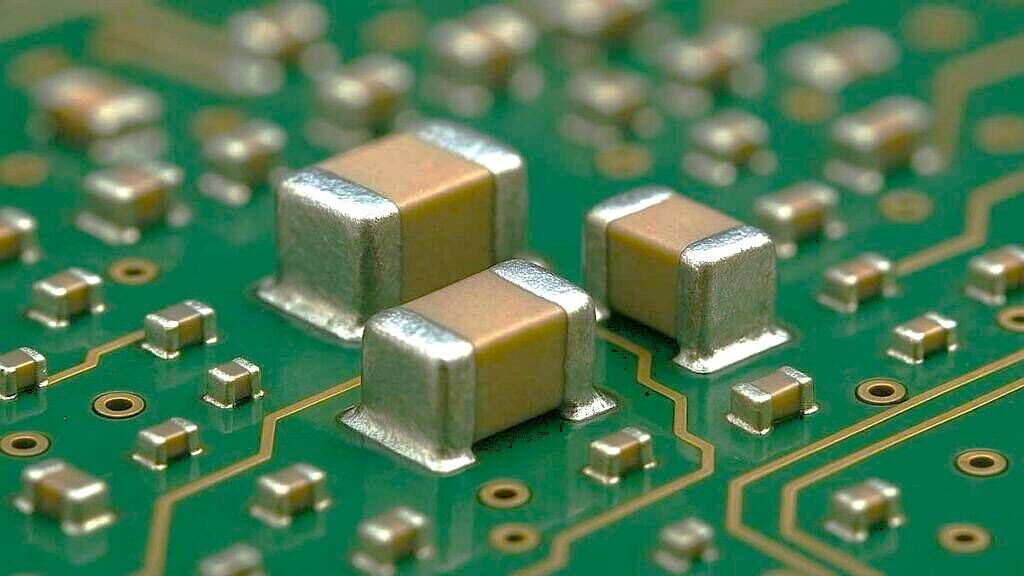

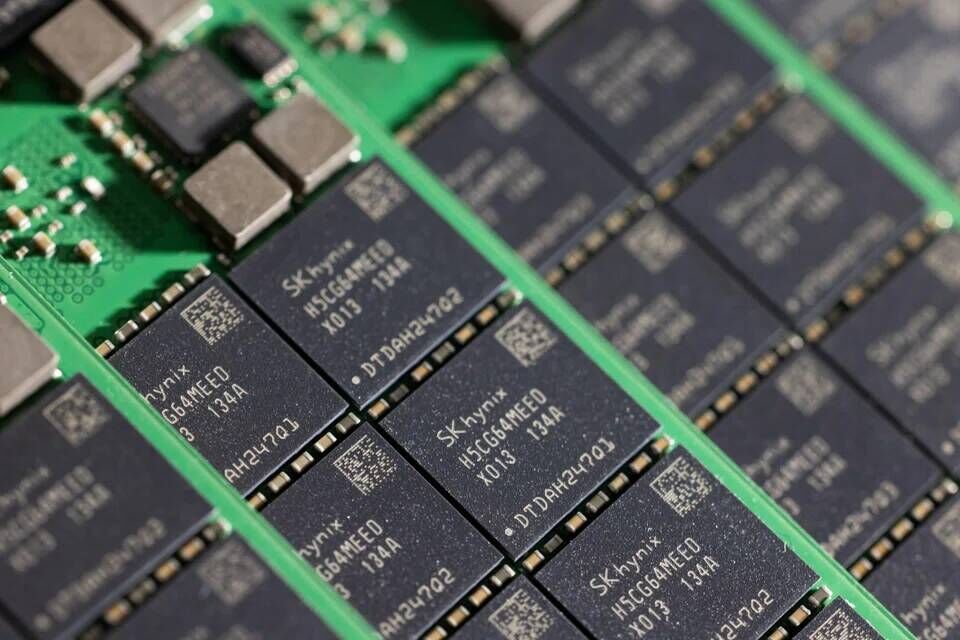

Pulse Electronics is a world-leading leading supplier of electronic components, mainly for wireless components such as 3D printed antennas, laser-shaped antennas and various antenna modules, as well as high-end transformers, integrated connector modules, and high frequency chip inductors, power supplies and cable systems. Yageo is optimistic about Pulse's achievements in automotive electronics and industrial specifications, which will help increase Yageo's product portfolio and increase its market share in the automotive electronics and industrial niche markets. In addition, this will also enhance Yageo's presence in the US and European business scale and visibility.

All Comments (0)