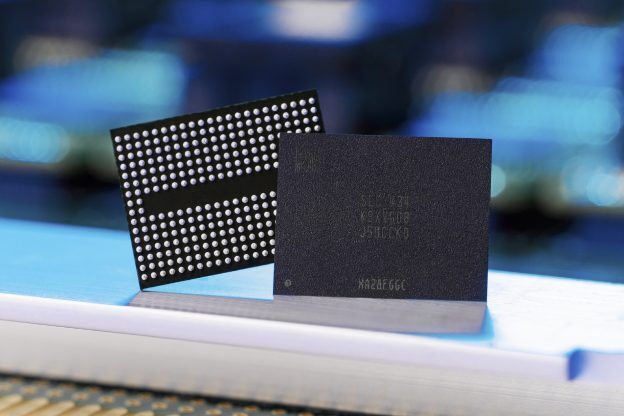

Samsung raises DDR5 prices as AI-driven demand strains supply

November 17, 2025 /SemiMedia/ — Samsung Electronics is lifting contract prices for several DDR5 memory products in November, as the rapid expansion of AI data centers tightens global supply, according to industry sources. Some of the new pricing levels represent increases of up to 60% compared with September.

People familiar with the matter said Samsung postponed the release of its October contract prices as the company reassessed demand and supply allocations. The sharp price rises are centered on high-capacity server modules, prompting some enterprise customers to accept premiums to secure allocations.

Server memory shortages push enterprise buyers to pay premiums

Distributors report that the supply gap is widening. Tobey Gonnerman, president of Fusion Worldwide, said major server manufacturers and data center builders are struggling to obtain enough memory. “They are paying substantial premiums simply to ensure supply,” he said.

High-capacity DDR5 modules see steep contract price increases

Market data shows Samsung’s 32GB DDR5 contract price has climbed from US$149 in September to around US$239 in November. Prices for 16GB and 128GB modules have risen by about 50%, while 64GB and 96GB products also recorded strong increases.

DDR5 remains essential for high-performance computing, enabling fast data movement for servers, PCs and AI workloads. Analysts say shortages have already resulted in early buying and stockpiling among some customers.

Rising DRAM prices strengthen Samsung’s market leverage

The shortage has strengthened Samsung’s pricing leverage in DRAM, even as the company trails some competitors in AI processor development. Jeff Kim, head of research at KB Securities, noted that Samsung’s position in memory gives it more flexibility than rivals such as SK Hynix and Micron.

Customers secure long-term DRAM agreements through 2027

TrendForce analyst Ellie Wang expects Samsung’s DRAM contract prices in the fourth quarter to rise 40% to 50%, exceeding the industry’s average projected increase of around 30%. She added that customers are negotiating long-term agreements through 2026, with some extending into 2027, underscoring confidence in continued AI-driven demand.

All Comments (0)