October 29, 2025 /SemiMedia/ — In late September 2025, the Dutch government invoked a Cold War-era law to take control of Nexperia, a Chinese-owned semiconductor manufacturer headquartered in Nijmegen. The company, a key European supplier of power and automotive chips, became the center of a fast-escalating geopolitical dispute. The move triggered swift international reactions — China imposed export restrictions, internal rifts emerged between European and Chinese management, and the global automotive industry once again faced renewed supply risks.

Dutch decision: balancing security and political pressure

Caretaker Economy Minister Vincent Karremans cited the Goods Distribution Act in a three-page letter to parliament, saying the intervention aimed to “prevent critical technology from leaving the country.” The Amsterdam District Court approved the government’s request for temporary trusteeship.

Karremans, 38, a former health official who assumed the economy portfolio following coalition turmoil, said Nexperia plays “a crucial role in the Dutch and European semiconductor ecosystem,” describing the move as necessary to avoid an uncontrollable situation.

Sources familiar with the matter said the intervention partly stemmed from a restructuring plan pushed by former CEO Zhang Xuezheng, who is also the founder of Nexperia’s Chinese parent company, Wingtech. The plan included optimizing European operations, potentially closing the Munich R&D center, and shifting parts of manufacturing to China — proposals regulators viewed as risks of “critical technology outflow.”

Multiple media outlets reported that U.S. officials had warned the Dutch government as early as June that Nexperia could face export restrictions or sanctions if it failed to reform its governance structure and replace Chinese executives. The warning added to the pressure on The Hague to act.

Split and countermeasures: from state actions to corporate division

China responded on October 4 by announcing export controls on certain chips produced by Nexperia’s Chinese plants, directly affecting its packaging and testing operations and causing shipment delays worldwide.

Tensions also spilled inside the company. Reports from various outlets said divisions had formed between the Dutch headquarters and the Chinese subsidiary over operations and financial control. Nexperia China later issued an internal notice instructing employees to follow local management, resume domestic sales, and emphasize operational independence — effectively creating a dual management structure divided along geopolitical lines.

Automotive shockwaves: the chip gap returns

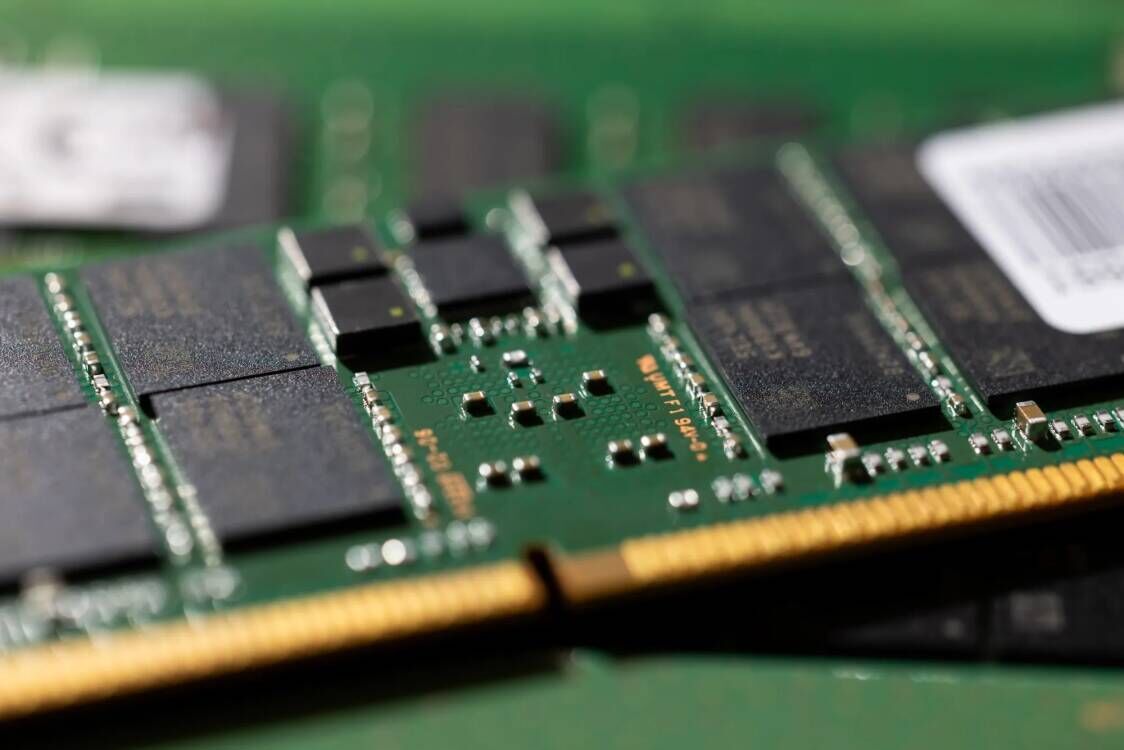

Nexperia’s chips are not high-end processors but essential components for vehicle braking, steering, and power systems. Any disruption in its output immediately ripples through the automotive sector.

- The European Automobile Manufacturers’ Association (ACEA) warned that chip inventories could run out within weeks.

- Japan’s automakers called for governments to “find a prompt resolution.”

- Volkswagen acknowledged short-term production risks, describing the situation as “highly unstable.”

- Volvo Cars’ CEO said the company faced no immediate impact but warned that some car plants around the world could be forced to halt production if shortages persisted.

- Chinese distributors reported over 10 days of halted deliveries, saying they were “running out of stock.”

A small automotive chip has once again exposed the fragility of the global supply chain, echoing memories of the semiconductor shortages that paralyzed production during the pandemic.

Outlook: a test for global supply resilience

The Dutch government has expressed its intention to engage in high-level dialogue with Beijing to defuse tensions. But repairing trust may prove far harder than restarting production.

The Nexperia episode has become a watershed moment for Europe’s semiconductor strategy and the broader global tech order. It underscores a sobering reality: in an era of geopolitical sensitivity, control over even basic components can become a matter of national security. For the industry, building a more resilient and diversified supply chain is no longer a strategic option — it is a prerequisite for survival.

All Comments (0)