October 13, 2025 /SemiMedia/ — Amid escalating U.S.–China trade friction, Japanese electronic components makers are aggressively restructuring their global manufacturing footprint to mitigate geopolitical exposure. Transformer manufacturer Tamura has announced plans to reduce its China operations by up to 30% and pivot production toward Europe and Mexico.

Tamura currently maintains 11 sites in China spanning production and sales. Under its scheme, to be realized by March 2028, some of those will be shuttered or relocated. Starting November 2025, Tamura will begin large-scale production of current sensors in Saitama Prefecture near Tokyo—assets previously concentrated in China. In December, the company intends to divest one of its Chinese joint ventures to a local buyer.

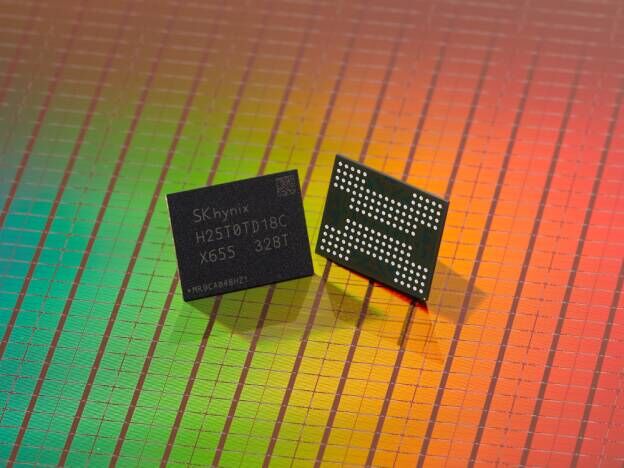

Meanwhile, TDK is shifting its battery cell operations outward from China: it plans to bring smartphone battery module production online in Haryana, India, by year’s end. Although TDK retains China as a core production hub, its global expansion plan aims to follow clients relocating to India and beyond.

On the capacitor side, Murata is expected to inaugurate its first India-based surface-mount MLCC (multi-layer ceramic capacitor) facility in fiscal 2026 and is weighing full local production capacity in the future. Murata’s leadership notes the firm is reinforcing multiple supply routes in response to prolonged U.S.–China tensions.

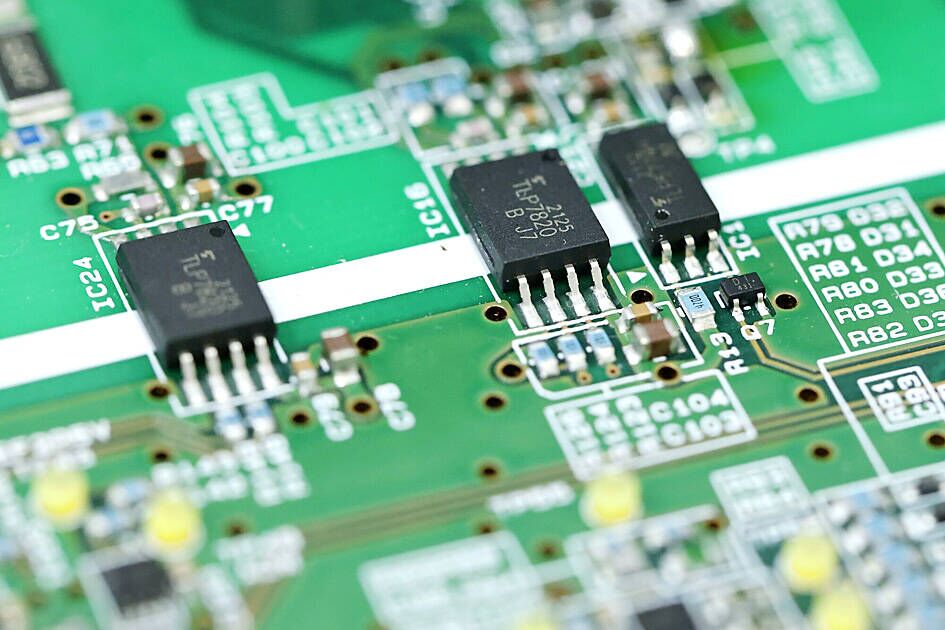

PCB maker Meiko has also made moves: in 2025 it completed a ¥50 billion factory in Vietnam to serve iPhone assembly plants in India and the broader region. Over recent years Meiko’s China-based production share has slid—from roughly 70% in FY2018 to under 50% in FY2024.

As Japanese component makers reposition their manufacturing strategies, the overarching drive is clear: establish more resilient, diversified supply chains to withstand tariff risk and geopolitical volatility.

All Comments (0)