May 22, 2025 /SemiMedia/ — Reports that Wolfspeed is preparing to file for Chapter 11 bankruptcy protection have sent ripples through the global SiC supply chain, with suppliers from the Taiwan region positioned to absorb displaced orders.

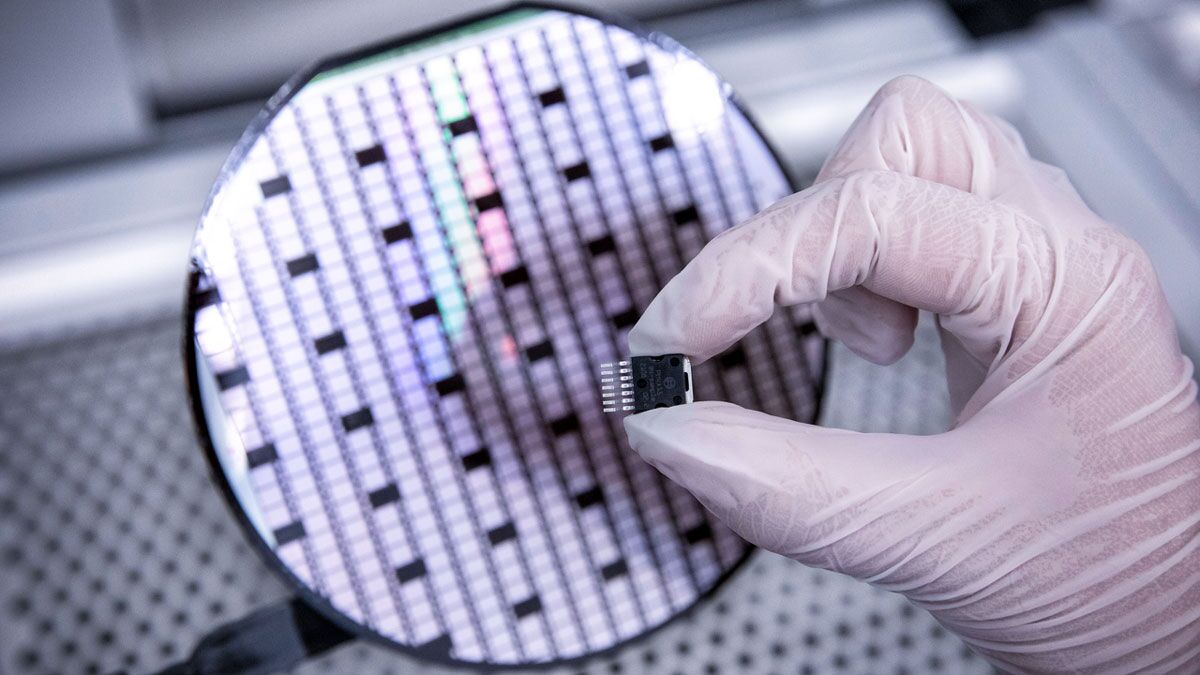

Wolfspeed, a major producer of third-generation semiconductors, has been hit by weak demand in industrial and automotive markets, coupled with uncertainty over U.S. trade tariffs. Media sources say the company has received an out-of-court restructuring proposal from creditors and is preparing for bankruptcy proceedings.

In response, shares of Taiwan-based SiC suppliers including Hestia (Hana Microelectronics), Episil, and Mosel Vitelic surged, as the market anticipates that Wolfspeed’s restructuring or potential liquidation could trigger large-scale order shifts.

Hestia, a specialist in SiC and GaN foundry services, works in close partnership with epitaxial wafer supplier Episil. The two have jointly secured orders from leading European and Japanese chipmakers, highlighting their competitiveness in the power semiconductor segment.

Wolfspeed’s potential exit is also expected to accelerate VIS’s expansion into 8-inch SiC wafer manufacturing. Backed by Hestia’s technical expertise, VIS—its largest shareholder—can rapidly scale in the third-generation semiconductor market.

In parallel, Mosel Vitelic is on track to complete its SiC production line this year. Analysts see strong potential for Mosel and its affiliate Powerchip to win power module orders from Japanese and European customers previously served by Wolfspeed.

While competition from Chinese and Western suppliers remains intense, Taiwan's manufacturers offer distinct advantages: foundry capabilities, long-standing client relationships, and a more favorable tariff position compared to China. These factors are expected to help Taiwan's SiC ecosystem capture a meaningful portion of Wolfspeed’s displaced demand.

All Comments (0)