May 20, 2025 /SemiMedia/ — TSMC is reportedly preparing to raise its wafer foundry prices by approximately 10%, a move drawing attention across the semiconductor industry. Nvidia CEO Jensen Huang, following a recent meeting with TSMC Chairman Mark Liu and executives, voiced his support, stating that the high cost of advanced nodes is “very worthful,” signaling strong endorsement for the price adjustment.

Industry sources attribute the planned price increase to rising costs at TSMC’s U.S. fabs, inflationary pressures, currency volatility, and increased capital investment in leading-edge process technologies. Notably, TSMC’s Arizona fab may raise 4nm pricing by as much as 30% to reflect the elevated cost of U.S.-based manufacturing.

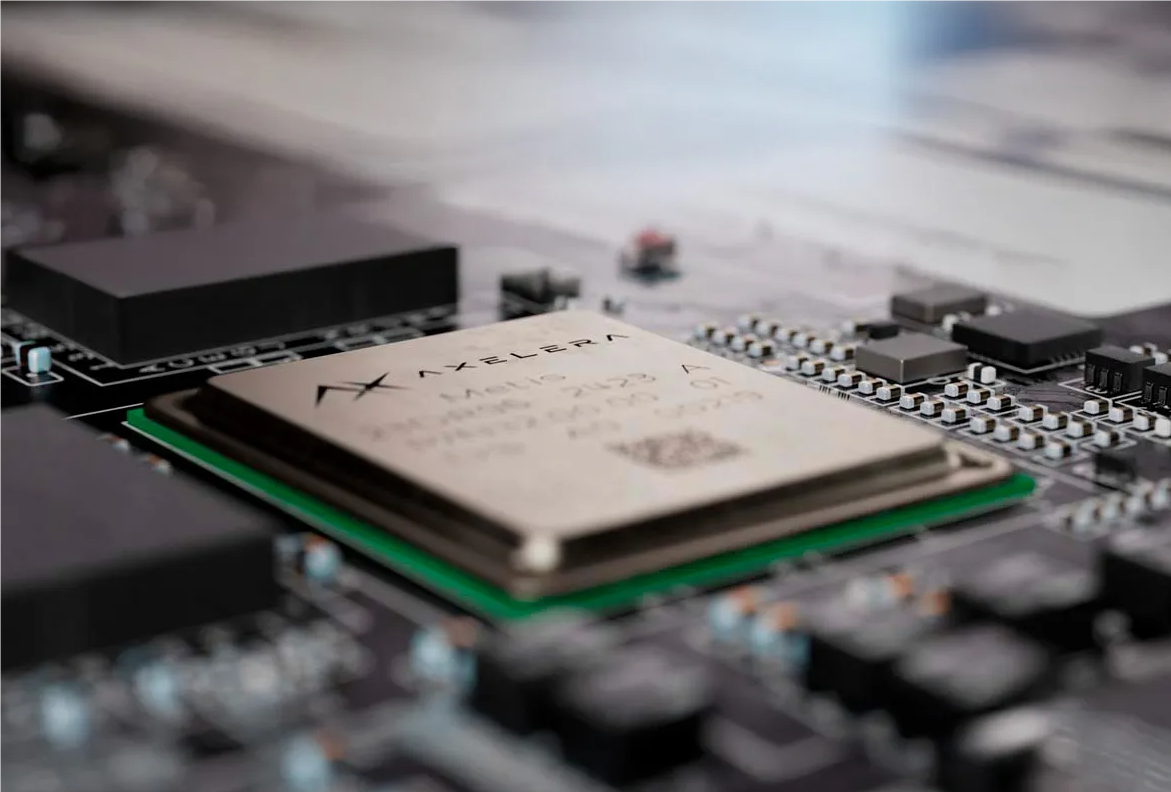

During TSMC’s latest earnings call, Chairman Mark Liu emphasized that AI processors — including CPUs, GPUs, and AI accelerators — are driving significant growth. Revenue from this segment is expected to double this year, with a compound annual growth rate (CAGR) of nearly 45% from 2024 to 2029. To maintain profit margins and sustain capital expenditures, pricing adjustments have become necessary.

Meanwhile, sources confirm that Nvidia is among TSMC’s 2nm customers, aiming to develop next-generation AI chips on this platform. As process nodes continue to shrink, complexity and failure risk rise, driving up wafer prices industry-wide.

Data from EDA (electronic design automation) companies suggest that the success rate of initial chip tape-outs has dropped sharply — from around 30% historically to 24% in 2023–2024, with projections of just 14% by 2025. This trend reflects rising R&D risks, especially for highly customized designs requiring extended verification cycles.

Many IC design firms note that switching foundries at advanced nodes is costly and time-consuming, increasing dependence on established partners like TSMC. Long-term collaborations are viewed as critical to securing performance, yield, and time-to-market advantages amid intense AI competition.

According to industry insiders, volume-based discounts remain in play at TSMC. Large clients such as Nvidia may face price hikes, but they continue to benefit from scale-driven advantages, including early access to new nodes and priority capacity allocation.

All Comments (0)