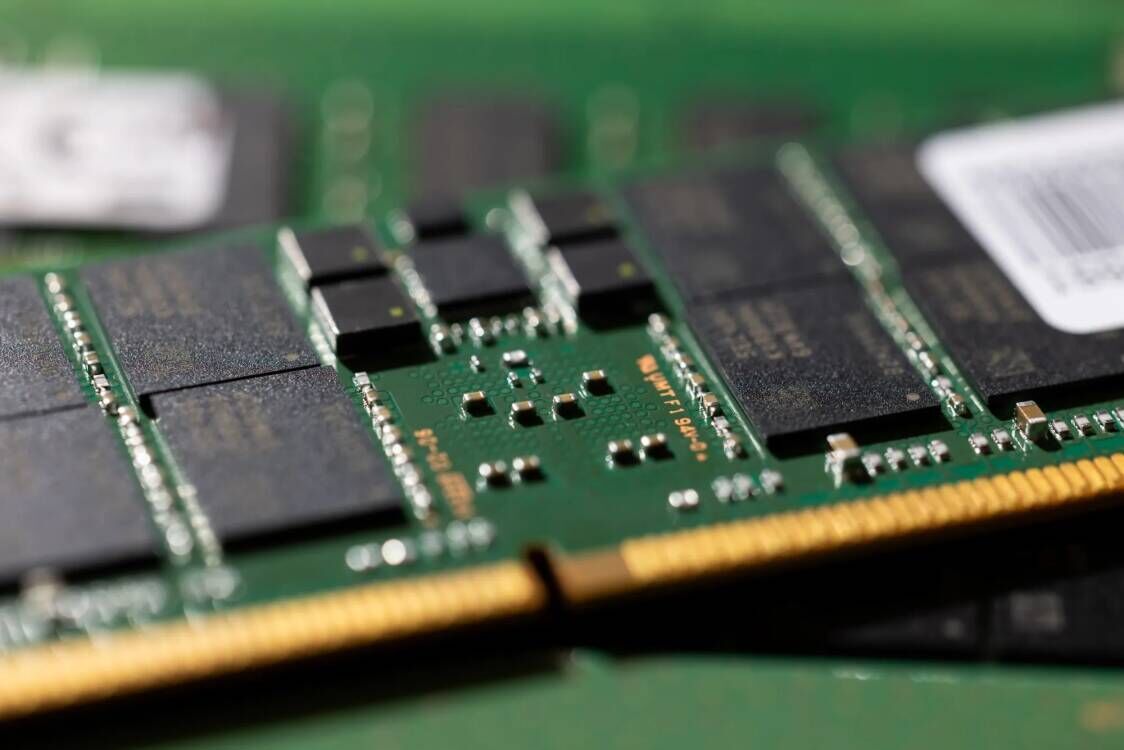

According to data from market research institutions, in January and February 2022, mobile phone shipments in the Chinese market were 47.886 million units, down 22.6% year-on-year, and 5G mobile phone shipments also declined, down 11% year-on-year. In February, the shipments of Xiaomi, OPPO, vivo, etc. all fell sharply year-on-year.

Mobile phone market analysts said that demand for Apple's first new mobile phone this year, the iPhone SE, is sluggish, and it is estimated that annual shipments will be cut by 10 million units; for Android, China's major Android phone brands have cut orders by about 170 million units this year, accounting for 20% of their original 2022 shipment plan.

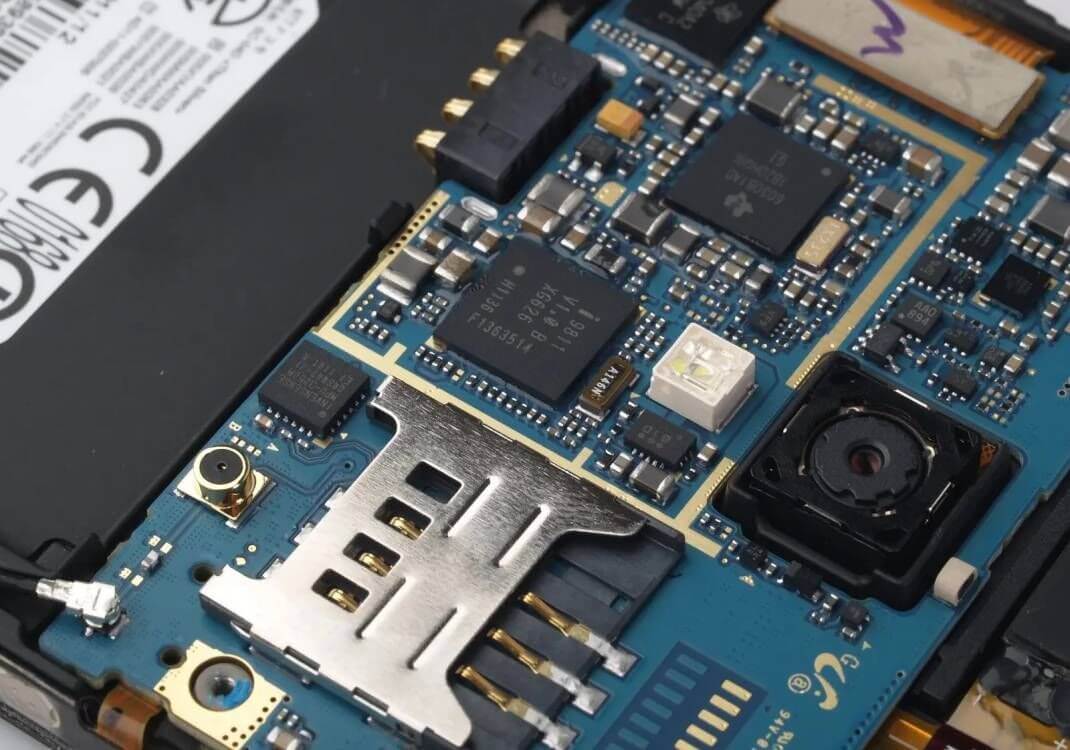

The report pointed out that MediaTek and Qualcomm have reduced orders for 5G chips in the second half of this year due to the downturn in the mobile phone market. MediaTek has scaled back orders by 30 to 35% in Q4 (mainly low-end and mid-range). Qualcomm's SM8475 and SM8550 shipment estimates remain unchanged, but the company has reduced orders for other high-end Snapdragon 8 series in the second half of the year by about 10 to 15%. It is expected that Qualcomm will reduce the price of the existing SM8450 and SM8475 by 30-40% after starting to ship the SM8550 at the end of this year to reduce inventory pressure.

In addition to 5G chips, display driver ICs have also been impacted by the market downturn. Supply chain sources have revealed that driver IC suppliers have reduced foundry production by as much as 30%.

Driver IC manufacturers admitted that when supply was in short supply, orders surged, but production capacity was limited. Customer demand has fallen sharply recently, so some orders to wafer foundries have been cut off.

All Comments (0)