As a private semiconductor foundry that has been established for 10 years, GlobalFoundries revealed that it will consider listing in 2022. According to reports, the listing will give GlobalFoundries current owners a partial return on investment of nearly $21 billion. However, there is still a long way to go before GlobalFoundries goes public. In order to successfully conduct an initial public offering, GlobalFoundries must become a continuously profitable company.

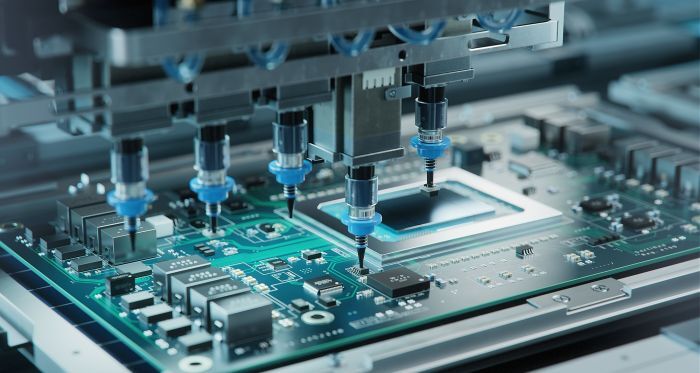

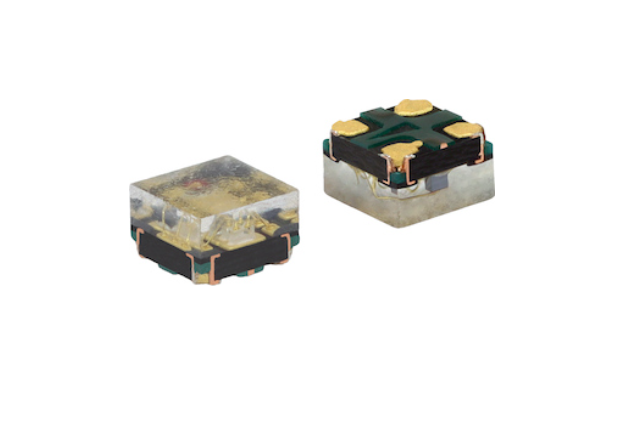

Founded in 2009, GlobalFoundries is a manufacturing company split from AMD and is now the world's third-largest chip maker after TSMC and Samsung. Over the years, the company has been trying to compete with TSMC and Samsung for its customers by providing leading chip manufacturing technology. However, GlobalFoundries replaced equipment in 2018 and abandoned cutting-edge process development like 7nm to focus on more profitable process nodes.

At present, GlobalFoundries has basically stopped competing with TSMC and Samsung Foundry, focusing on more profitable projects, rather than introducing a new leading process node every two years. As part of the restructuring, GlobalFoudries sold some of its assets, including two fabs and contract chip design company Avera Semiconductor.

Tom Caulfield, CEO of GlobalFoundries, said in an interview that GlobalFoundries' sole owner, Mubadala, plans to sell a minority stake in the company in 2022 to repay part of the funds and raise funds for further development. In addition, Tom Caulfield also stressed that IPO will be a turning point for the company.

All Comments (0)