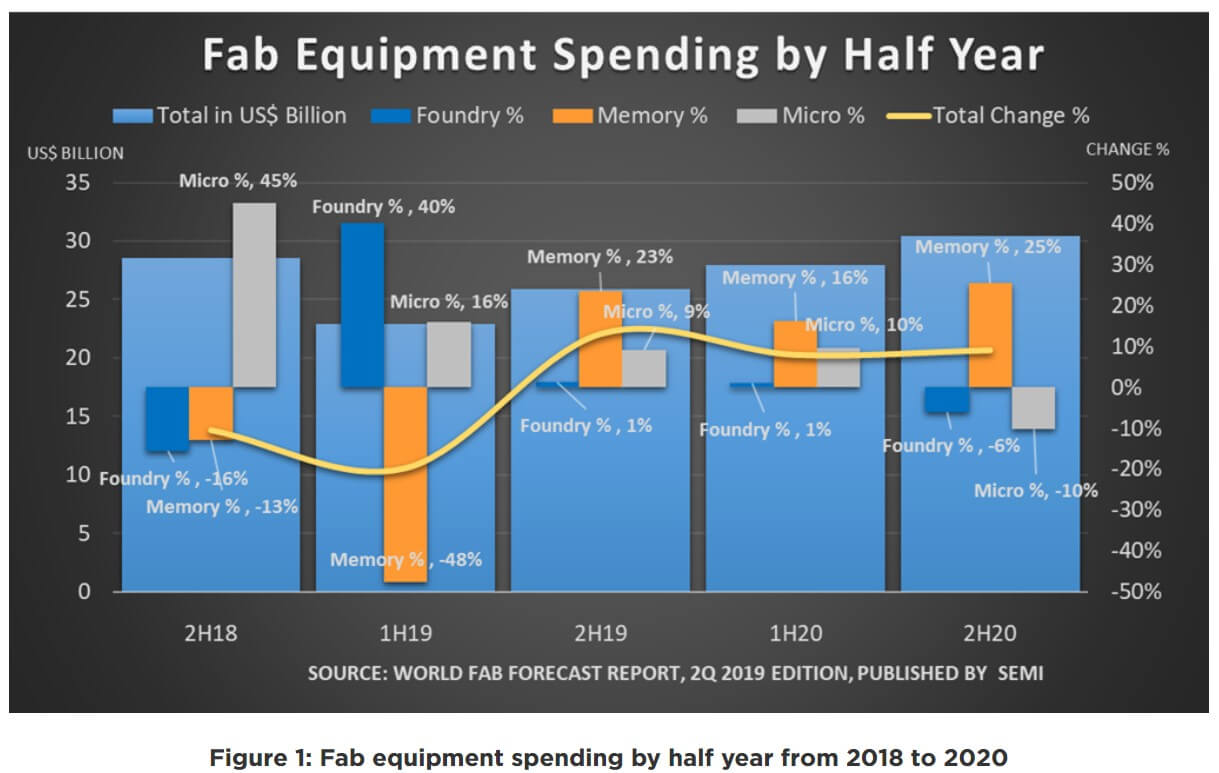

SEMI recently updated its global fab forecast report for the second quarter of 2019, and lowered its estimate of global fab equipment spending this year. According to the report, global fab equipment spending will fall 19% to 48.4 billion US dollars, down 5% from the previous estimate of 14%, and next year's growth rate will be reduced from the original 27% to 20%, reaching 58.4 billion US dollars . In addition, despite forecasting growth in 2020, fab spending in 2020 will still be $2 billion less than investment in 2018.

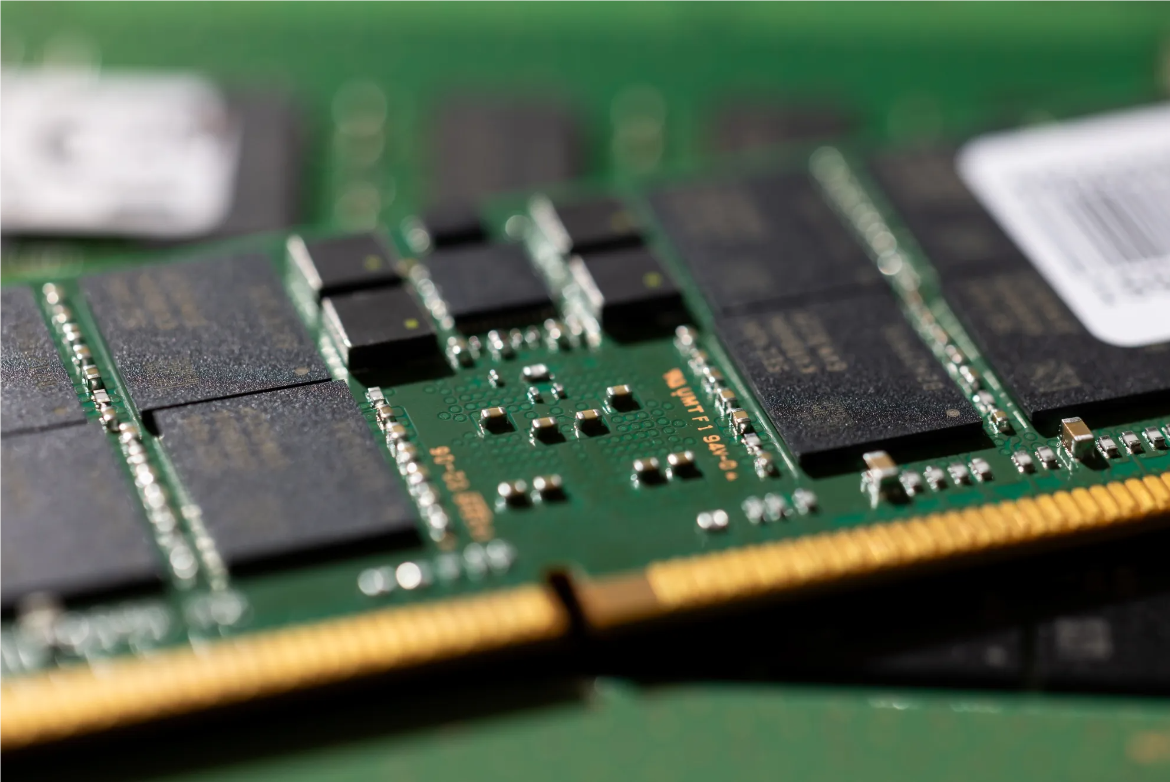

SEMI estimates that the memory industry's spending will fall by 45% in 2019, accounting for the majority of this year's decline, but is expected to recover strongly by 45% in 2020, reaching $28 billion. Memory-related investments will increase by more than $8 billion in 2020 compared to this year, and will drive the recovery of fab expenses. However, compared with 2017 and 2018, the memory-related investment will remain far below the previous level.

SEMI said that although the memory industry spending will be greatly reduced this year, investment in two industries is expected to grow against the trend. First, the investment in the foundry industry is expected to grow by 29%, driven by advanced processes and production capacity. The microprocessor chip industry is expected to grow by more than 40%, driven by the shipment of 10nm process microprocessors (MPUs). However, the overall cost of microprocessor chips is still much lower than foundry and memory.

SEMI also said that with the investment dynamics every six months, the memory expenditure will be reduced by 48% in the first half of this year, and the funds invested in 3D NAND and DRAM will fall by 60% and 40% respectively. However, the memory industry expenditure is expected to stabilize in the second half of this year, and will show a recovery in 2020.

All Comments (0)