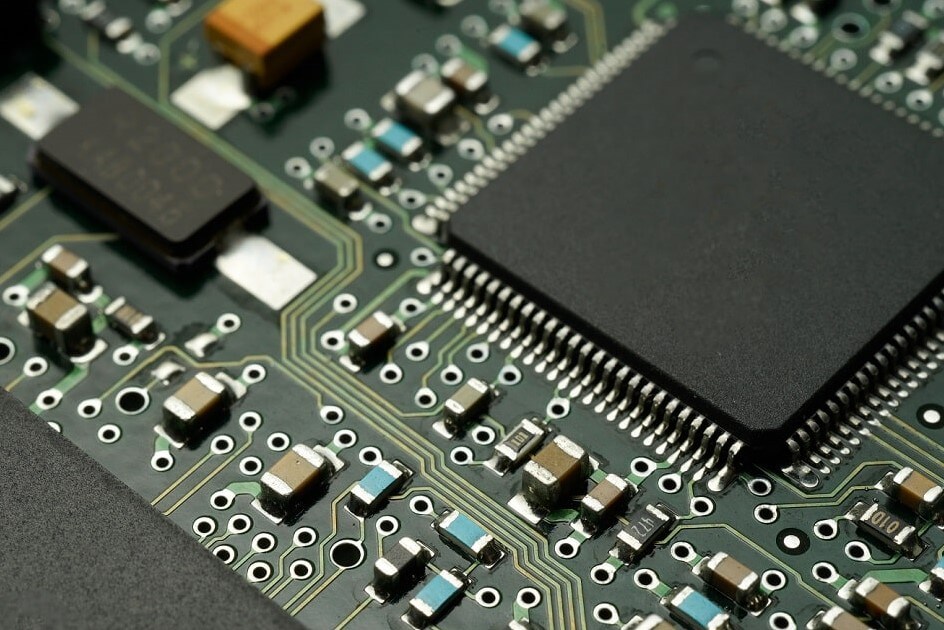

According to insiders in the passive component supply chain, Murata's MLCC lead time has recently begun to extend. In order to increase inventory and ensure sufficient inventory supply to customers, at present, some distributors have proposed to obtain priority supply from Murata at a higher purchase price.

The insider pointed out that Murata's MLCC product lead time extension is due to highly customized MLCC products, these products are used in the automotive and industrial fields, the current average lead time is more than 3 and a half months, the longest is 6 months. Among them, products with special specifications and high capacity have the longest lead time.

Murata's president Norio Nakajima said in an interview with the media a few days ago that demand from major global smartphone manufacturers such as Apple is booming, and the supply of MLCC products is tight. This situation is expected to continue until February. In addition, there is strong demand for small, high-capacity MLCCs for 5G smartphones, and the current production line utilization rate is close to 100%.

All Comments (0)