Recently, IC Insights released a report that the average price of each of the four largest pure-wafer foundries in Taiwan, TSMC, Globalfoundries, UMC and SMIC, increased by two dollars from last year, from $1,136 in 2017 to $1,138.

IC Insights believes that TSMC's average price in 2018 can reach $1,382 per piece, an increase of $14 compared to $1,368 per piece in 2107, an increase of 1.02%; Globalfoundries' average price in 2018 is expected to reach $1,014 per piece, compared to $1,008/Piece in 2017, increased by US$6, an increase of 0.60%; UMC and SMIC's average price per wafer is expected to decline, UMC dropped from $716 last year to $715 in 2018, and SMIC dropped from $719 last year to $671.

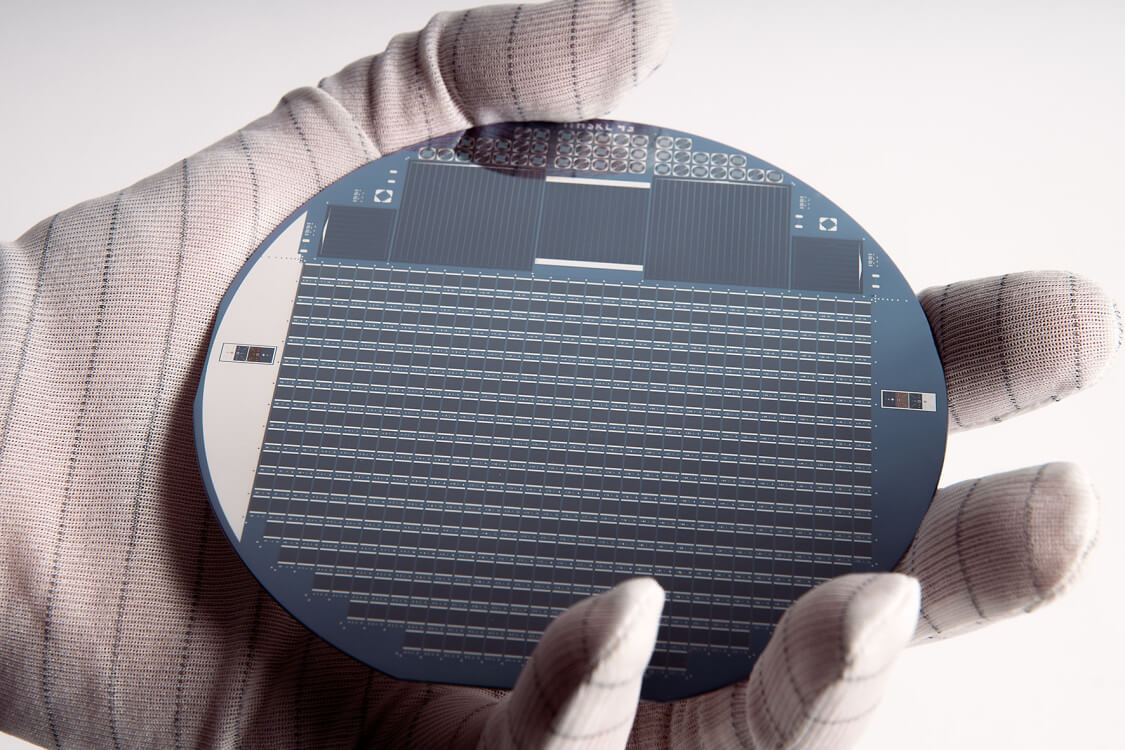

According to IC Insights, the overall increase in the average price of the above four manufacturers is mainly due to the improvement of process technology. For example, in a 300mm wafer, the 20nm process is priced at $6050/piece, while the 90nm process is priced at $1,800/piece. The 500mm process 200mm wafer is priced at only $370/piece.

It is worth mentioning that IC Insights believes that only three companies, TSMC, Samsung and Intel, will be able to provide more advanced process technology products, such as 10nm and 5nm, in the next five years. The three companies are highly competitive with each other, especially TSMC and Samsung.

All Comments (0)