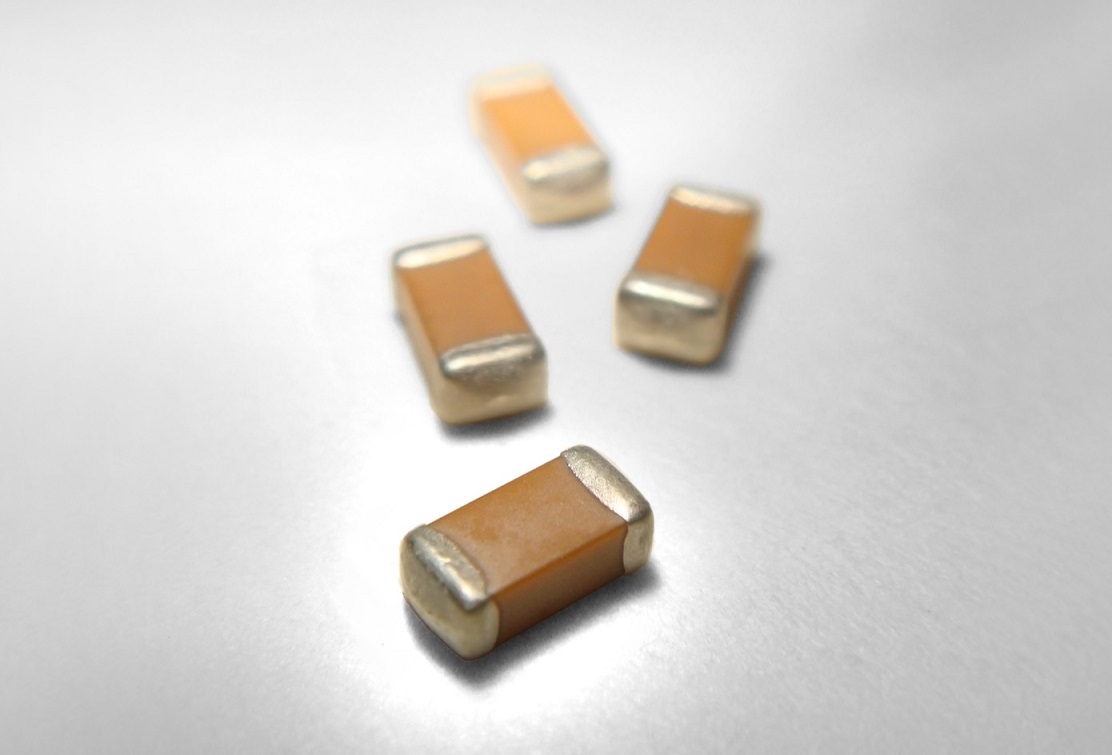

Walsin Technology Corporation recently predicted at the media meeting that the imbalance between supply and demand of passive components will be maintained until 2020. And from the middle of 2018, 5G and peripheral applications will grow rapidly, once again pulling the demand for passive components. The price of MLCC may rise again in the near future.

According to the supply chain, the shortage of MLCC supply cannot be solved by the end of 2019. Walsin pointed out that there are two main reasons for the imbalance between supply and demand. First, the continuous innovation of electronic technology, various new applications continue to emerge; Second, the expansion of MLCC is limited by the long lead time of production equipment, Raw material supply and limited industry talent. Therefore, the production capacity cannot keep up with the growth of demand.

In addition, Walsin stressed that so far, no new passive component suppliers in the market have the ability to provide a complete range of products with reliable quality in large scale. Therefore, Walsin believes that the supply of passive components will remain tight for a long time and will become the norm in the future. This situation will be maintained at least until 2020.

All Comments (0)