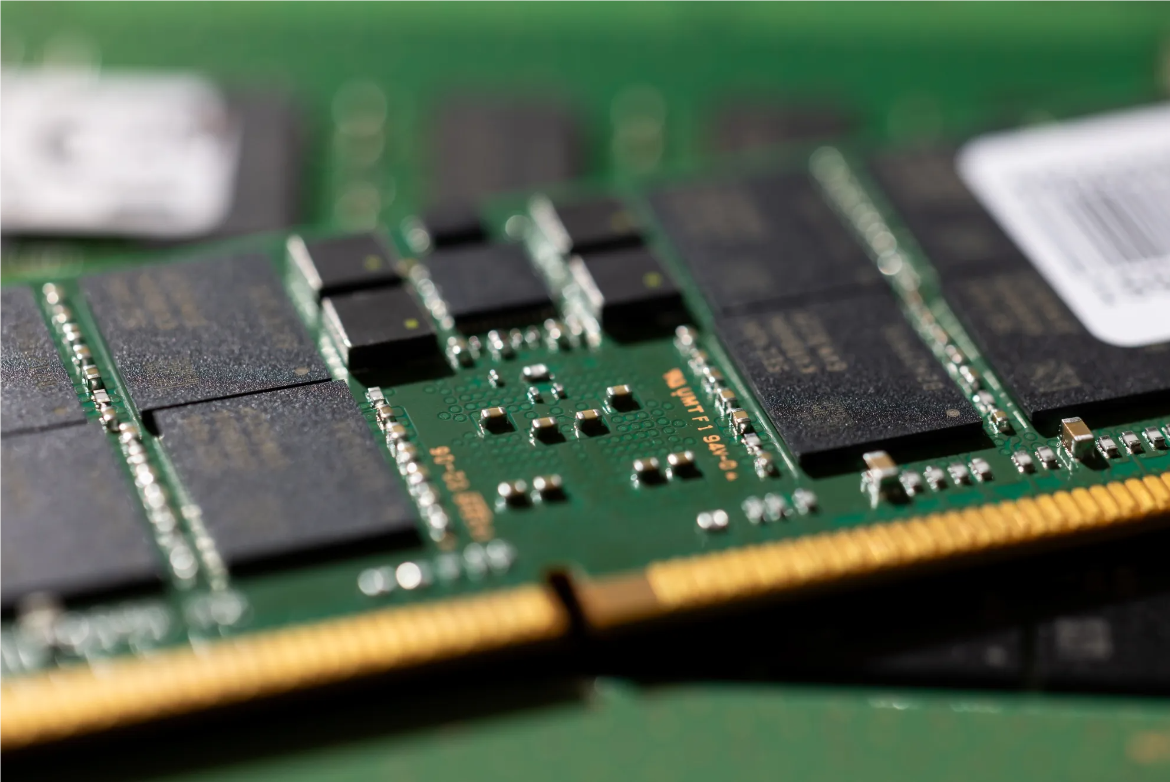

Recently, industry insiders pointed out that Samsung may reduce production of DRAM to prevent price decline.

Last year, the output value of DRAM and NAND chips exceeded $132 billion, accounting for one-third of the global semiconductor chip market, up 65% from 2016's $80 billion, it was mainly due to the price increase in the last two years. In 2018, The price of NAND flash memory has gradually declined, but the price of DRAM memory has remained high. According to industry insiders, the reason for this result is not just the market factor.

In fact, the memory and flash memory markets are highly monopolized. The major players of memory chips are mainly Samsung, SK Hynix and Micron. These three giants account for 95% of the global production capacity, while Samsung's market share has remained at 45-50% for a long time. In the last two years of memory and flash memory prices increase, these companies' revenues have risen steadily. Take Samsung as an example. In the first quarter of 2018, revenue was about 56.1 billion US dollars, up 19.8% year-on-year. Operating profit was 14.4 billion US dollars, up 58% year-on-year, while net profit was 10.7 billion US dollars, up 52% year-on-year. Among them, Samsung's chip business operating profit accounted for nearly 75% of total profit.

The price trend of DRAM is not just a matter of balance between supply and demand, the market has rumored that Samsung has taken measures to reduce production in order to prevent price reduction. Last month, Samsung's 18nm process encountered a yield problem, which will take two or three months to recover, but the problem will lead to shortage in the high-end server market. In fact, 18nm has been mass-produced for two years, the yield problem should be solved a long time ago, so after the yield problem came out, the industry expressed surprise.

Previously, UBS analyst Timothy Arcuri commented on the production cuts caused by Samsung's 18nm chip yield. He believes that there are many reasons for Samsung's behavior. Samsung may have encountered technical problems or may suspend production to control product supply. He pointed out that Samsung's production cuts before the price fell, this is unusual. He believes that Samsung's move is to implement the company's "profit first" management method in the past few years.

All Comments (0)